Advanced Quantitative Economics with Python

Additive and Multiplicative Functionals

29. Additive and Multiplicative Functionals¶

Contents

In addition to what’s in Anaconda, this lecture will need the following libraries:

!pip install --upgrade quantecon

Requirement already up-to-date: quantecon in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (0.5.0)

Requirement already satisfied, skipping upgrade: scipy>=1.0.0 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (1.5.2)

Requirement already satisfied, skipping upgrade: numba>=0.38 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (0.51.2)

Requirement already satisfied, skipping upgrade: numpy in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (1.19.2)

Requirement already satisfied, skipping upgrade: sympy in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (1.6.2)

Requirement already satisfied, skipping upgrade: requests in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (2.24.0)

Requirement already satisfied, skipping upgrade: setuptools in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from numba>=0.38->quantecon) (50.3.1.post20201107)

Requirement already satisfied, skipping upgrade: llvmlite<0.35,>=0.34.0.dev0 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from numba>=0.38->quantecon) (0.34.0)

Requirement already satisfied, skipping upgrade: mpmath>=0.19 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from sympy->quantecon) (1.1.0)

Requirement already satisfied, skipping upgrade: urllib3!=1.25.0,!=1.25.1,<1.26,>=1.21.1 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (1.25.11)

Requirement already satisfied, skipping upgrade: certifi>=2017.4.17 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (2020.12.5)

Requirement already satisfied, skipping upgrade: idna<3,>=2.5 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (2.10)

Requirement already satisfied, skipping upgrade: chardet<4,>=3.0.2 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (3.0.4)

29.1. Overview¶

Many economic time series display persistent growth that prevents them from being asymptotically stationary and ergodic.

For example, outputs, prices, and dividends typically display irregular but persistent growth.

Asymptotic stationarity and ergodicity are key assumptions needed to make it possible to learn by applying statistical methods.

Are there ways to model time series that have persistent growth that still enable statistical learning based on a law of large numbers for an asymptotically stationary and ergodic process?

The answer provided by Hansen and Scheinkman [HS09] is yes.

They described two classes of time series models that accommodate growth.

They are

additive functionals that display random “arithmetic growth”

multiplicative functionals that display random “geometric growth”

These two classes of processes are closely connected.

If a process \(\{y_t\}\) is an additive functional and \(\phi_t = \exp(y_t)\), then \(\{\phi_t\}\) is a multiplicative functional.

Hansen and Sargent [HS08b] (chs. 5 and 8) describe discrete time versions of additive and multiplicative functionals.

In this lecture, we describe both additive functionals and multiplicative functionals.

We also describe and compute decompositions of additive and multiplicative processes into four components:

a constant

a trend component

an asymptotically stationary component

a martingale

We describe how to construct, simulate, and interpret these components.

More details about these concepts and algorithms can be found in Hansen and Sargent [HS08b].

Let’s start with some imports:

import numpy as np

import scipy as sp

import scipy.linalg as la

import quantecon as qe

import matplotlib.pyplot as plt

%matplotlib inline

from scipy.stats import norm, lognorm

29.2. A Particular Additive Functional¶

Hansen and Sargent [HS08b] describe a general class of additive functionals.

This lecture focuses on a subclass of these: a scalar process \(\{y_t\}_{t=0}^\infty\) whose increments are driven by a Gaussian vector autoregression.

Our special additive functional displays interesting time series behavior while also being easy to construct, simulate, and analyze by using linear state-space tools.

We construct our additive functional from two pieces, the first of which is a first-order vector autoregression (VAR)

Here

\(x_t\) is an \(n \times 1\) vector,

\(A\) is an \(n \times n\) stable matrix (all eigenvalues lie within the open unit circle),

\(z_{t+1} \sim {\cal N}(0,I)\) is an \(m \times 1\) IID shock,

\(B\) is an \(n \times m\) matrix, and

\(x_0 \sim {\cal N}(\mu_0, \Sigma_0)\) is a random initial condition for \(x\)

The second piece is an equation that expresses increments of \(\{y_t\}_{t=0}^\infty\) as linear functions of

a scalar constant \(\nu\),

the vector \(x_t\), and

the same Gaussian vector \(z_{t+1}\) that appears in the VAR (29.1)

In particular,

Here \(y_0 \sim {\cal N}(\mu_{y0}, \Sigma_{y0})\) is a random initial condition for \(y\).

The nonstationary random process \(\{y_t\}_{t=0}^\infty\) displays systematic but random arithmetic growth.

29.2.1. Linear State-Space Representation¶

A convenient way to represent our additive functional is to use a linear state space system.

To do this, we set up state and observation vectors

Next we construct a linear system

This can be written as

which is a standard linear state space system.

To study it, we could map it into an instance of LinearStateSpace from QuantEcon.py.

But here we will use a different set of code for simulation, for reasons described below.

29.3. Dynamics¶

Let’s run some simulations to build intuition.

In doing so we’ll assume that \(z_{t+1}\) is scalar and that \(\tilde x_t\) follows a 4th-order scalar autoregression.

in which the zeros \(z\) of the polynomial

are strictly greater than unity in absolute value.

(Being a zero of \(\phi(z)\) means that \(\phi(z) = 0\))

Let the increment in \(\{y_t\}\) obey

with an initial condition for \(y_0\).

While (29.3) is not a first order system like (29.1), we know that it can be mapped into a first order system.

For an example of such a mapping, see this example.

In fact, this whole model can be mapped into the additive functional system definition in (29.1) – (29.2) by appropriate selection of the matrices \(A, B, D, F\).

You can try writing these matrices down now as an exercise — correct expressions appear in the code below.

29.3.1. Simulation¶

When simulating we embed our variables into a bigger system.

This system also constructs the components of the decompositions of \(y_t\) and of \(\exp(y_t)\) proposed by Hansen and Scheinkman [HS09].

All of these objects are computed using the code below

class AMF_LSS_VAR:

"""

This class transforms an additive (multiplicative)

functional into a QuantEcon linear state space system.

"""

def __init__(self, A, B, D, F=None, ν=None):

# Unpack required elements

self.nx, self.nk = B.shape

self.A, self.B = A, B

# Checking the dimension of D (extended from the scalar case)

if len(D.shape) > 1 and D.shape[0] != 1:

self.nm = D.shape[0]

self.D = D

elif len(D.shape) > 1 and D.shape[0] == 1:

self.nm = 1

self.D = D

else:

self.nm = 1

self.D = np.expand_dims(D, 0)

# Create space for additive decomposition

self.add_decomp = None

self.mult_decomp = None

# Set F

if not np.any(F):

self.F = np.zeros((self.nk, 1))

else:

self.F = F

# Set ν

if not np.any(ν):

self.ν = np.zeros((self.nm, 1))

elif type(ν) == float:

self.ν = np.asarray([[ν]])

elif len(ν.shape) == 1:

self.ν = np.expand_dims(ν, 1)

else:

self.ν = ν

if self.ν.shape[0] != self.D.shape[0]:

raise ValueError("The dimension of ν is inconsistent with D!")

# Construct BIG state space representation

self.lss = self.construct_ss()

def construct_ss(self):

"""

This creates the state space representation that can be passed

into the quantecon LSS class.

"""

# Pull out useful info

nx, nk, nm = self.nx, self.nk, self.nm

A, B, D, F, ν = self.A, self.B, self.D, self.F, self.ν

if self.add_decomp:

ν, H, g = self.add_decomp

else:

ν, H, g = self.additive_decomp()

# Auxiliary blocks with 0's and 1's to fill out the lss matrices

nx0c = np.zeros((nx, 1))

nx0r = np.zeros(nx)

nx1 = np.ones(nx)

nk0 = np.zeros(nk)

ny0c = np.zeros((nm, 1))

ny0r = np.zeros(nm)

ny1m = np.eye(nm)

ny0m = np.zeros((nm, nm))

nyx0m = np.zeros_like(D)

# Build A matrix for LSS

# Order of states is: [1, t, xt, yt, mt]

A1 = np.hstack([1, 0, nx0r, ny0r, ny0r]) # Transition for 1

A2 = np.hstack([1, 1, nx0r, ny0r, ny0r]) # Transition for t

# Transition for x_{t+1}

A3 = np.hstack([nx0c, nx0c, A, nyx0m.T, nyx0m.T])

# Transition for y_{t+1}

A4 = np.hstack([ν, ny0c, D, ny1m, ny0m])

# Transition for m_{t+1}

A5 = np.hstack([ny0c, ny0c, nyx0m, ny0m, ny1m])

Abar = np.vstack([A1, A2, A3, A4, A5])

# Build B matrix for LSS

Bbar = np.vstack([nk0, nk0, B, F, H])

# Build G matrix for LSS

# Order of observation is: [xt, yt, mt, st, tt]

# Selector for x_{t}

G1 = np.hstack([nx0c, nx0c, np.eye(nx), nyx0m.T, nyx0m.T])

G2 = np.hstack([ny0c, ny0c, nyx0m, ny1m, ny0m]) # Selector for y_{t}

# Selector for martingale

G3 = np.hstack([ny0c, ny0c, nyx0m, ny0m, ny1m])

G4 = np.hstack([ny0c, ny0c, -g, ny0m, ny0m]) # Selector for stationary

G5 = np.hstack([ny0c, ν, nyx0m, ny0m, ny0m]) # Selector for trend

Gbar = np.vstack([G1, G2, G3, G4, G5])

# Build H matrix for LSS

Hbar = np.zeros((Gbar.shape[0], nk))

# Build LSS type

x0 = np.hstack([1, 0, nx0r, ny0r, ny0r])

S0 = np.zeros((len(x0), len(x0)))

lss = qe.lss.LinearStateSpace(Abar, Bbar, Gbar, Hbar, mu_0=x0, Sigma_0=S0)

return lss

def additive_decomp(self):

"""

Return values for the martingale decomposition

- ν : unconditional mean difference in Y

- H : coefficient for the (linear) martingale component (κ_a)

- g : coefficient for the stationary component g(x)

- Y_0 : it should be the function of X_0 (for now set it to 0.0)

"""

I = np.identity(self.nx)

A_res = la.solve(I - self.A, I)

g = self.D @ A_res

H = self.F + self.D @ A_res @ self.B

return self.ν, H, g

def multiplicative_decomp(self):

"""

Return values for the multiplicative decomposition (Example 5.4.4.)

- ν_tilde : eigenvalue

- H : vector for the Jensen term

"""

ν, H, g = self.additive_decomp()

ν_tilde = ν + (.5)*np.expand_dims(np.diag(H @ H.T), 1)

return ν_tilde, H, g

def loglikelihood_path(self, x, y):

A, B, D, F = self.A, self.B, self.D, self.F

k, T = y.shape

FF = F @ F.T

FFinv = la.inv(FF)

temp = y[:, 1:] - y[:, :-1] - D @ x[:, :-1]

obs = temp * FFinv * temp

obssum = np.cumsum(obs)

scalar = (np.log(la.det(FF)) + k*np.log(2*np.pi))*np.arange(1, T)

return -(.5)*(obssum + scalar)

def loglikelihood(self, x, y):

llh = self.loglikelihood_path(x, y)

return llh[-1]

29.3.1.1. Plotting¶

The code below adds some functions that generate plots for instances of the AMF_LSS_VAR class.

def plot_given_paths(amf, T, ypath, mpath, spath, tpath,

mbounds, sbounds, horline=0, show_trend=True):

# Allocate space

trange = np.arange(T)

# Create figure

fig, ax = plt.subplots(2, 2, sharey=True, figsize=(15, 8))

# Plot all paths together

ax[0, 0].plot(trange, ypath[0, :], label="$y_t$", color="k")

ax[0, 0].plot(trange, mpath[0, :], label="$m_t$", color="m")

ax[0, 0].plot(trange, spath[0, :], label="$s_t$", color="g")

if show_trend:

ax[0, 0].plot(trange, tpath[0, :], label="$t_t$", color="r")

ax[0, 0].axhline(horline, color="k", linestyle="-.")

ax[0, 0].set_title("One Path of All Variables")

ax[0, 0].legend(loc="upper left")

# Plot Martingale Component

ax[0, 1].plot(trange, mpath[0, :], "m")

ax[0, 1].plot(trange, mpath.T, alpha=0.45, color="m")

ub = mbounds[1, :]

lb = mbounds[0, :]

ax[0, 1].fill_between(trange, lb, ub, alpha=0.25, color="m")

ax[0, 1].set_title("Martingale Components for Many Paths")

ax[0, 1].axhline(horline, color="k", linestyle="-.")

# Plot Stationary Component

ax[1, 0].plot(spath[0, :], color="g")

ax[1, 0].plot(spath.T, alpha=0.25, color="g")

ub = sbounds[1, :]

lb = sbounds[0, :]

ax[1, 0].fill_between(trange, lb, ub, alpha=0.25, color="g")

ax[1, 0].axhline(horline, color="k", linestyle="-.")

ax[1, 0].set_title("Stationary Components for Many Paths")

# Plot Trend Component

if show_trend:

ax[1, 1].plot(tpath.T, color="r")

ax[1, 1].set_title("Trend Components for Many Paths")

ax[1, 1].axhline(horline, color="k", linestyle="-.")

return fig

def plot_additive(amf, T, npaths=25, show_trend=True):

"""

Plots for the additive decomposition.

Acts on an instance amf of the AMF_LSS_VAR class

"""

# Pull out right sizes so we know how to increment

nx, nk, nm = amf.nx, amf.nk, amf.nm

# Allocate space (nm is the number of additive functionals -

# we want npaths for each)

mpath = np.empty((nm*npaths, T))

mbounds = np.empty((nm*2, T))

spath = np.empty((nm*npaths, T))

sbounds = np.empty((nm*2, T))

tpath = np.empty((nm*npaths, T))

ypath = np.empty((nm*npaths, T))

# Simulate for as long as we wanted

moment_generator = amf.lss.moment_sequence()

# Pull out population moments

for t in range (T):

tmoms = next(moment_generator)

ymeans = tmoms[1]

yvar = tmoms[3]

# Lower and upper bounds - for each additive functional

for ii in range(nm):

li, ui = ii*2, (ii+1)*2

mscale = np.sqrt(yvar[nx+nm+ii, nx+nm+ii])

sscale = np.sqrt(yvar[nx+2*nm+ii, nx+2*nm+ii])

if mscale == 0.0:

mscale = 1e-12 # avoids a RuntimeWarning from calculating ppf

if sscale == 0.0: # of normal distribution with std dev = 0.

sscale = 1e-12 # sets std dev to small value instead

madd_dist = norm(ymeans[nx+nm+ii], mscale)

sadd_dist = norm(ymeans[nx+2*nm+ii], sscale)

mbounds[li:ui, t] = madd_dist.ppf([0.01, .99])

sbounds[li:ui, t] = sadd_dist.ppf([0.01, .99])

# Pull out paths

for n in range(npaths):

x, y = amf.lss.simulate(T)

for ii in range(nm):

ypath[npaths*ii+n, :] = y[nx+ii, :]

mpath[npaths*ii+n, :] = y[nx+nm + ii, :]

spath[npaths*ii+n, :] = y[nx+2*nm + ii, :]

tpath[npaths*ii+n, :] = y[nx+3*nm + ii, :]

add_figs = []

for ii in range(nm):

li, ui = npaths*(ii), npaths*(ii+1)

LI, UI = 2*(ii), 2*(ii+1)

add_figs.append(plot_given_paths(amf, T,

ypath[li:ui,:],

mpath[li:ui,:],

spath[li:ui,:],

tpath[li:ui,:],

mbounds[LI:UI,:],

sbounds[LI:UI,:],

show_trend=show_trend))

add_figs[ii].suptitle(f'Additive decomposition of $y_{ii+1}$',

fontsize=14)

return add_figs

def plot_multiplicative(amf, T, npaths=25, show_trend=True):

"""

Plots for the multiplicative decomposition

"""

# Pull out right sizes so we know how to increment

nx, nk, nm = amf.nx, amf.nk, amf.nm

# Matrices for the multiplicative decomposition

ν_tilde, H, g = amf.multiplicative_decomp()

# Allocate space (nm is the number of functionals -

# we want npaths for each)

mpath_mult = np.empty((nm*npaths, T))

mbounds_mult = np.empty((nm*2, T))

spath_mult = np.empty((nm*npaths, T))

sbounds_mult = np.empty((nm*2, T))

tpath_mult = np.empty((nm*npaths, T))

ypath_mult = np.empty((nm*npaths, T))

# Simulate for as long as we wanted

moment_generator = amf.lss.moment_sequence()

# Pull out population moments

for t in range(T):

tmoms = next(moment_generator)

ymeans = tmoms[1]

yvar = tmoms[3]

# Lower and upper bounds - for each multiplicative functional

for ii in range(nm):

li, ui = ii*2, (ii+1)*2

Mdist = lognorm(np.sqrt(yvar[nx+nm+ii, nx+nm+ii]).item(),

scale=np.exp(ymeans[nx+nm+ii] \

- t * (.5)

* np.expand_dims(

np.diag(H @ H.T),

1

)[ii]

).item()

)

Sdist = lognorm(np.sqrt(yvar[nx+2*nm+ii, nx+2*nm+ii]).item(),

scale = np.exp(-ymeans[nx+2*nm+ii]).item())

mbounds_mult[li:ui, t] = Mdist.ppf([.01, .99])

sbounds_mult[li:ui, t] = Sdist.ppf([.01, .99])

# Pull out paths

for n in range(npaths):

x, y = amf.lss.simulate(T)

for ii in range(nm):

ypath_mult[npaths*ii+n, :] = np.exp(y[nx+ii, :])

mpath_mult[npaths*ii+n, :] = np.exp(y[nx+nm + ii, :] \

- np.arange(T)*(.5)

* np.expand_dims(np.diag(H

@ H.T),

1)[ii]

)

spath_mult[npaths*ii+n, :] = 1/np.exp(-y[nx+2*nm + ii, :])

tpath_mult[npaths*ii+n, :] = np.exp(y[nx+3*nm + ii, :]

+ np.arange(T)*(.5)

* np.expand_dims(np.diag(H

@ H.T),

1)[ii]

)

mult_figs = []

for ii in range(nm):

li, ui = npaths*(ii), npaths*(ii+1)

LI, UI = 2*(ii), 2*(ii+1)

mult_figs.append(plot_given_paths(amf,T,

ypath_mult[li:ui,:],

mpath_mult[li:ui,:],

spath_mult[li:ui,:],

tpath_mult[li:ui,:],

mbounds_mult[LI:UI,:],

sbounds_mult[LI:UI,:],

1,

show_trend=show_trend))

mult_figs[ii].suptitle(f'Multiplicative decomposition of \

$y_{ii+1}$', fontsize=14)

return mult_figs

def plot_martingale_paths(amf, T, mpath, mbounds, horline=1, show_trend=False):

# Allocate space

trange = np.arange(T)

# Create figure

fig, ax = plt.subplots(1, 1, figsize=(10, 6))

# Plot Martingale Component

ub = mbounds[1, :]

lb = mbounds[0, :]

ax.fill_between(trange, lb, ub, color="#ffccff")

ax.axhline(horline, color="k", linestyle="-.")

ax.plot(trange, mpath.T, linewidth=0.25, color="#4c4c4c")

return fig

def plot_martingales(amf, T, npaths=25):

# Pull out right sizes so we know how to increment

nx, nk, nm = amf.nx, amf.nk, amf.nm

# Matrices for the multiplicative decomposition

ν_tilde, H, g = amf.multiplicative_decomp()

# Allocate space (nm is the number of functionals -

# we want npaths for each)

mpath_mult = np.empty((nm*npaths, T))

mbounds_mult = np.empty((nm*2, T))

# Simulate for as long as we wanted

moment_generator = amf.lss.moment_sequence()

# Pull out population moments

for t in range (T):

tmoms = next(moment_generator)

ymeans = tmoms[1]

yvar = tmoms[3]

# Lower and upper bounds - for each functional

for ii in range(nm):

li, ui = ii*2, (ii+1)*2

Mdist = lognorm(np.sqrt(yvar[nx+nm+ii, nx+nm+ii]).item(),

scale= np.exp(ymeans[nx+nm+ii] \

- t * (.5)

* np.expand_dims(

np.diag(H @ H.T),

1)[ii]

).item()

)

mbounds_mult[li:ui, t] = Mdist.ppf([.01, .99])

# Pull out paths

for n in range(npaths):

x, y = amf.lss.simulate(T)

for ii in range(nm):

mpath_mult[npaths*ii+n, :] = np.exp(y[nx+nm + ii, :] \

- np.arange(T) * (.5)

* np.expand_dims(np.diag(H

@ H.T),

1)[ii]

)

mart_figs = []

for ii in range(nm):

li, ui = npaths*(ii), npaths*(ii+1)

LI, UI = 2*(ii), 2*(ii+1)

mart_figs.append(plot_martingale_paths(amf, T, mpath_mult[li:ui, :],

mbounds_mult[LI:UI, :],

horline=1))

mart_figs[ii].suptitle(f'Martingale components for many paths of \

$y_{ii+1}$', fontsize=14)

return mart_figs

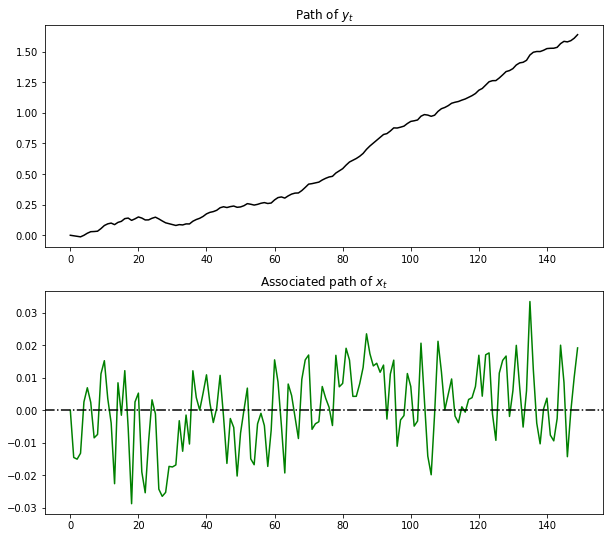

For now, we just plot \(y_t\) and \(x_t\), postponing until later a description of exactly how we compute them.

ϕ_1, ϕ_2, ϕ_3, ϕ_4 = 0.5, -0.2, 0, 0.5

σ = 0.01

ν = 0.01 # Growth rate

# A matrix should be n x n

A = np.array([[ϕ_1, ϕ_2, ϕ_3, ϕ_4],

[ 1, 0, 0, 0],

[ 0, 1, 0, 0],

[ 0, 0, 1, 0]])

# B matrix should be n x k

B = np.array([[σ, 0, 0, 0]]).T

D = np.array([1, 0, 0, 0]) @ A

F = np.array([1, 0, 0, 0]) @ B

amf = AMF_LSS_VAR(A, B, D, F, ν=ν)

T = 150

x, y = amf.lss.simulate(T)

fig, ax = plt.subplots(2, 1, figsize=(10, 9))

ax[0].plot(np.arange(T), y[amf.nx, :], color='k')

ax[0].set_title('Path of $y_t$')

ax[1].plot(np.arange(T), y[0, :], color='g')

ax[1].axhline(0, color='k', linestyle='-.')

ax[1].set_title('Associated path of $x_t$')

plt.show()

Notice the irregular but persistent growth in \(y_t\).

29.3.2. Decomposition¶

Hansen and Sargent [HS08b] describe how to construct a decomposition of an additive functional into four parts:

a constant inherited from initial values \(x_0\) and \(y_0\)

a linear trend

a martingale

an (asymptotically) stationary component

To attain this decomposition for the particular class of additive functionals defined by (29.1) and (29.2), we first construct the matrices

Then the Hansen-Scheinkman [HS09] decomposition is

At this stage, you should pause and verify that \(y_{t+1} - y_t\) satisfies (29.2).

It is convenient for us to introduce the following notation:

\(\tau_t = \nu t\) , a linear, deterministic trend

\(m_t = \sum_{j=1}^t H z_j\), a martingale with time \(t+1\) increment \(H z_{t+1}\)

\(s_t = g x_t\), an (asymptotically) stationary component

We want to characterize and simulate components \(\tau_t, m_t, s_t\) of the decomposition.

A convenient way to do this is to construct an appropriate instance of a linear state space system by using LinearStateSpace from QuantEcon.py.

This will allow us to use the routines in LinearStateSpace to study dynamics.

To start, observe that, under the dynamics in (29.1) and (29.2) and with the definitions just given,

and

With

we can write this as the linear state space system

By picking out components of \(\tilde y_t\), we can track all variables of interest.

29.4. Code¶

The class AMF_LSS_VAR mentioned above does all that we want to study our additive functional.

In fact, AMF_LSS_VAR does more

because it allows us to study an associated multiplicative functional as well.

(A hint that it does more is the name of the class – here AMF stands for “additive and multiplicative functional” – the code computes and displays objects associated with multiplicative functionals too.)

Let’s use this code (embedded above) to explore the example process described above.

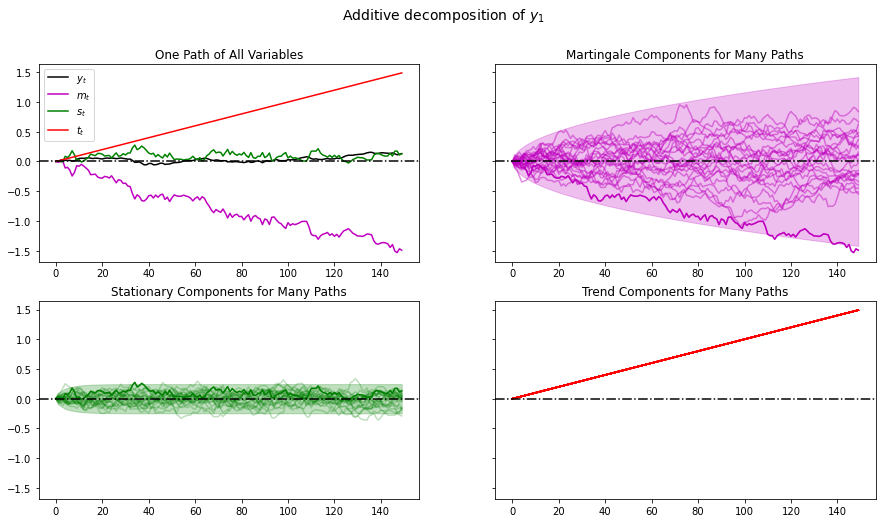

If you run the code that first simulated that example again and then the method call you will generate (modulo randomness) the plot

plot_additive(amf, T)

plt.show()

When we plot multiple realizations of a component in the 2nd, 3rd, and 4th panels, we also plot the population 95% probability coverage sets computed using the LinearStateSpace class.

We have chosen to simulate many paths, all starting from the same non-random initial conditions \(x_0, y_0\) (you can tell this from the shape of the 95% probability coverage shaded areas).

Notice tell-tale signs of these probability coverage shaded areas

the purple one for the martingale component \(m_t\) grows with \(\sqrt{t}\)

the green one for the stationary component \(s_t\) converges to a constant band

29.4.1. Associated Multiplicative Functional¶

Where \(\{y_t\}\) is our additive functional, let \(M_t = \exp(y_t)\).

As mentioned above, the process \(\{M_t\}\) is called a multiplicative functional.

Corresponding to the additive decomposition described above we have a multiplicative decomposition of \(M_t\)

or

where

and

An instance of class AMF_LSS_VAR (above) includes this associated multiplicative functional as an attribute.

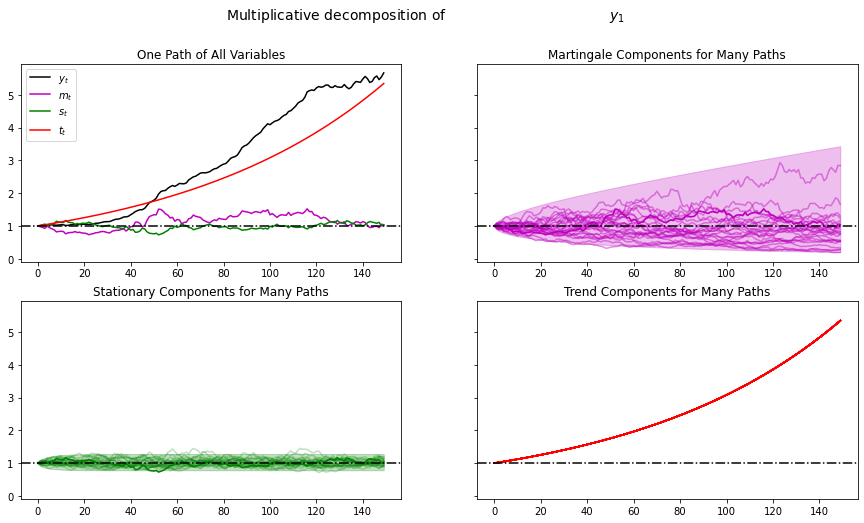

Let’s plot this multiplicative functional for our example.

If you run the code that first simulated that example again and then the method call in the cell below you’ll obtain the graph in the next cell.

plot_multiplicative(amf, T)

plt.show()

As before, when we plotted multiple realizations of a component in the 2nd, 3rd, and 4th panels, we also plotted population 95% confidence bands computed using the LinearStateSpace class.

Comparing this figure and the last also helps show how geometric growth differs from arithmetic growth.

The top right panel of the above graph shows a panel of martingales associated with the panel of \(M_t = \exp(y_t)\) that we have generated for a limited horizon \(T\).

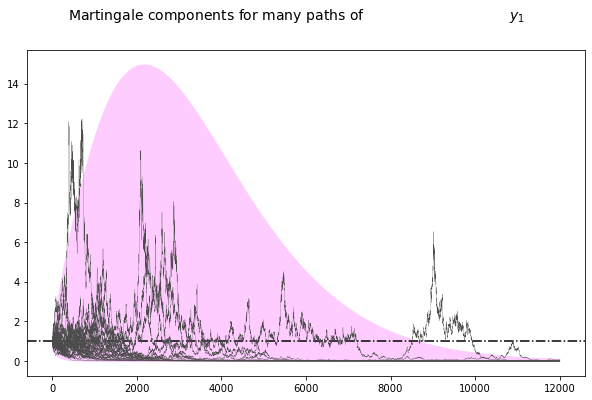

It is interesting to how the martingale behaves as \(T \rightarrow +\infty\).

Let’s see what happens when we set \(T = 12000\) instead of \(150\).

29.4.2. Peculiar Large Sample Property¶

Hansen and Sargent [HS08b] (ch. 8) describe the following two properties of the martingale component \(\widetilde M_t\) of the multiplicative decomposition

while \(E_0 \widetilde M_t = 1\) for all \(t \geq 0\), nevertheless \(\ldots\)

as \(t \rightarrow +\infty\), \(\widetilde M_t\) converges to zero almost surely

The first property follows from the fact that \(\widetilde M_t\) is a multiplicative martingale with initial condition \(\widetilde M_0 = 1\).

The second is a peculiar property noted and proved by Hansen and Sargent [HS08b].

The following simulation of many paths of \(\widetilde M_t\) illustrates both properties

np.random.seed(10021987)

plot_martingales(amf, 12000)

plt.show()

The dotted line in the above graph is the mean \(E \tilde M_t = 1\) of the martingale.

It remains constant at unity, illustrating the first property.

The purple 95 percent frequency coverage interval collapses around zero, illustrating the second property.

29.5. More About the Multiplicative Martingale¶

Let’s drill down and study probability distribution of the multiplicative martingale \(\{\widetilde M_t\}_{t=0}^\infty\) in more detail.

As we have seen, it has representation

where \(H = [F + D(I-A)^{-1} B]\).

It follows that \(\log {\widetilde M}_t \sim {\mathcal N} ( -\frac{t H \cdot H}{2}, t H \cdot H )\) and that consequently \({\widetilde M}_t\) is log normal.

29.5.1. Simulating a Multiplicative Martingale Again¶

Next, we want a program to simulate the likelihood ratio process \(\{ \tilde{M}_t \}_{t=0}^\infty\).

In particular, we want to simulate 5000 sample paths of length \(T\) for the case in which \(x\) is a scalar and \([A, B, D, F] = [0.8, 0.001, 1.0, 0.01]\) and \(\nu = 0.005\).

After accomplishing this, we want to display and study histograms of \(\tilde{M}_T^i\) for various values of \(T\).

Here is code that accomplishes these tasks.

29.5.2. Sample Paths¶

Let’s write a program to simulate sample paths of \(\{ x_t, y_{t} \}_{t=0}^{\infty}\).

We’ll do this by formulating the additive functional as a linear state space model and putting the LinearStateSpace class to work.

class AMF_LSS_VAR:

"""

This class is written to transform a scalar additive functional

into a linear state space system.

"""

def __init__(self, A, B, D, F=0.0, ν=0.0):

# Unpack required elements

self.A, self.B, self.D, self.F, self.ν = A, B, D, F, ν

# Create space for additive decomposition

self.add_decomp = None

self.mult_decomp = None

# Construct BIG state space representation

self.lss = self.construct_ss()

def construct_ss(self):

"""

This creates the state space representation that can be passed

into the quantecon LSS class.

"""

# Pull out useful info

A, B, D, F, ν = self.A, self.B, self.D, self.F, self.ν

nx, nk, nm = 1, 1, 1

if self.add_decomp:

ν, H, g = self.add_decomp

else:

ν, H, g = self.additive_decomp()

# Build A matrix for LSS

# Order of states is: [1, t, xt, yt, mt]

A1 = np.hstack([1, 0, 0, 0, 0]) # Transition for 1

A2 = np.hstack([1, 1, 0, 0, 0]) # Transition for t

A3 = np.hstack([0, 0, A, 0, 0]) # Transition for x_{t+1}

A4 = np.hstack([ν, 0, D, 1, 0]) # Transition for y_{t+1}

A5 = np.hstack([0, 0, 0, 0, 1]) # Transition for m_{t+1}

Abar = np.vstack([A1, A2, A3, A4, A5])

# Build B matrix for LSS

Bbar = np.vstack([0, 0, B, F, H])

# Build G matrix for LSS

# Order of observation is: [xt, yt, mt, st, tt]

G1 = np.hstack([0, 0, 1, 0, 0]) # Selector for x_{t}

G2 = np.hstack([0, 0, 0, 1, 0]) # Selector for y_{t}

G3 = np.hstack([0, 0, 0, 0, 1]) # Selector for martingale

G4 = np.hstack([0, 0, -g, 0, 0]) # Selector for stationary

G5 = np.hstack([0, ν, 0, 0, 0]) # Selector for trend

Gbar = np.vstack([G1, G2, G3, G4, G5])

# Build H matrix for LSS

Hbar = np.zeros((1, 1))

# Build LSS type

x0 = np.hstack([1, 0, 0, 0, 0])

S0 = np.zeros((5, 5))

lss = qe.lss.LinearStateSpace(Abar, Bbar, Gbar, Hbar,

mu_0=x0, Sigma_0=S0)

return lss

def additive_decomp(self):

"""

Return values for the martingale decomposition (Proposition 4.3.3.)

- ν : unconditional mean difference in Y

- H : coefficient for the (linear) martingale component (kappa_a)

- g : coefficient for the stationary component g(x)

- Y_0 : it should be the function of X_0 (for now set it to 0.0)

"""

A_res = 1 / (1 - self.A)

g = self.D * A_res

H = self.F + self.D * A_res * self.B

return self.ν, H, g

def multiplicative_decomp(self):

"""

Return values for the multiplicative decomposition (Example 5.4.4.)

- ν_tilde : eigenvalue

- H : vector for the Jensen term

"""

ν, H, g = self.additive_decomp()

ν_tilde = ν + (.5) * H**2

return ν_tilde, H, g

def loglikelihood_path(self, x, y):

A, B, D, F = self.A, self.B, self.D, self.F

T = y.T.size

FF = F**2

FFinv = 1 / FF

temp = y[1:] - y[:-1] - D * x[:-1]

obs = temp * FFinv * temp

obssum = np.cumsum(obs)

scalar = (np.log(FF) + np.log(2 * np.pi)) * np.arange(1, T)

return (-0.5) * (obssum + scalar)

def loglikelihood(self, x, y):

llh = self.loglikelihood_path(x, y)

return llh[-1]

The heavy lifting is done inside the AMF_LSS_VAR class.

The following code adds some simple functions that make it straightforward to generate sample paths from an instance of AMF_LSS_VAR.

def simulate_xy(amf, T):

"Simulate individual paths."

foo, bar = amf.lss.simulate(T)

x = bar[0, :]

y = bar[1, :]

return x, y

def simulate_paths(amf, T=150, I=5000):

"Simulate multiple independent paths."

# Allocate space

storeX = np.empty((I, T))

storeY = np.empty((I, T))

for i in range(I):

# Do specific simulation

x, y = simulate_xy(amf, T)

# Fill in our storage matrices

storeX[i, :] = x

storeY[i, :] = y

return storeX, storeY

def population_means(amf, T=150):

# Allocate Space

xmean = np.empty(T)

ymean = np.empty(T)

# Pull out moment generator

moment_generator = amf.lss.moment_sequence()

for tt in range (T):

tmoms = next(moment_generator)

ymeans = tmoms[1]

xmean[tt] = ymeans[0]

ymean[tt] = ymeans[1]

return xmean, ymean

Now that we have these functions in our toolkit, let’s apply them to run some simulations.

def simulate_martingale_components(amf, T=1000, I=5000):

# Get the multiplicative decomposition

ν, H, g = amf.multiplicative_decomp()

# Allocate space

add_mart_comp = np.empty((I, T))

# Simulate and pull out additive martingale component

for i in range(I):

foo, bar = amf.lss.simulate(T)

# Martingale component is third component

add_mart_comp[i, :] = bar[2, :]

mul_mart_comp = np.exp(add_mart_comp - (np.arange(T) * H**2)/2)

return add_mart_comp, mul_mart_comp

# Build model

amf_2 = AMF_LSS_VAR(0.8, 0.001, 1.0, 0.01,.005)

amc, mmc = simulate_martingale_components(amf_2, 1000, 5000)

amcT = amc[:, -1]

mmcT = mmc[:, -1]

print("The (min, mean, max) of additive Martingale component in period T is")

print(f"\t ({np.min(amcT)}, {np.mean(amcT)}, {np.max(amcT)})")

print("The (min, mean, max) of multiplicative Martingale component \

in period T is")

print(f"\t ({np.min(mmcT)}, {np.mean(mmcT)}, {np.max(mmcT)})")

The (min, mean, max) of additive Martingale component in period T is

(-1.8379907335579106, 0.011040789361757435, 1.4697384727035145)

The (min, mean, max) of multiplicative Martingale component in period T is

(0.14222026893384476, 1.006753060146832, 3.8858858377907133)

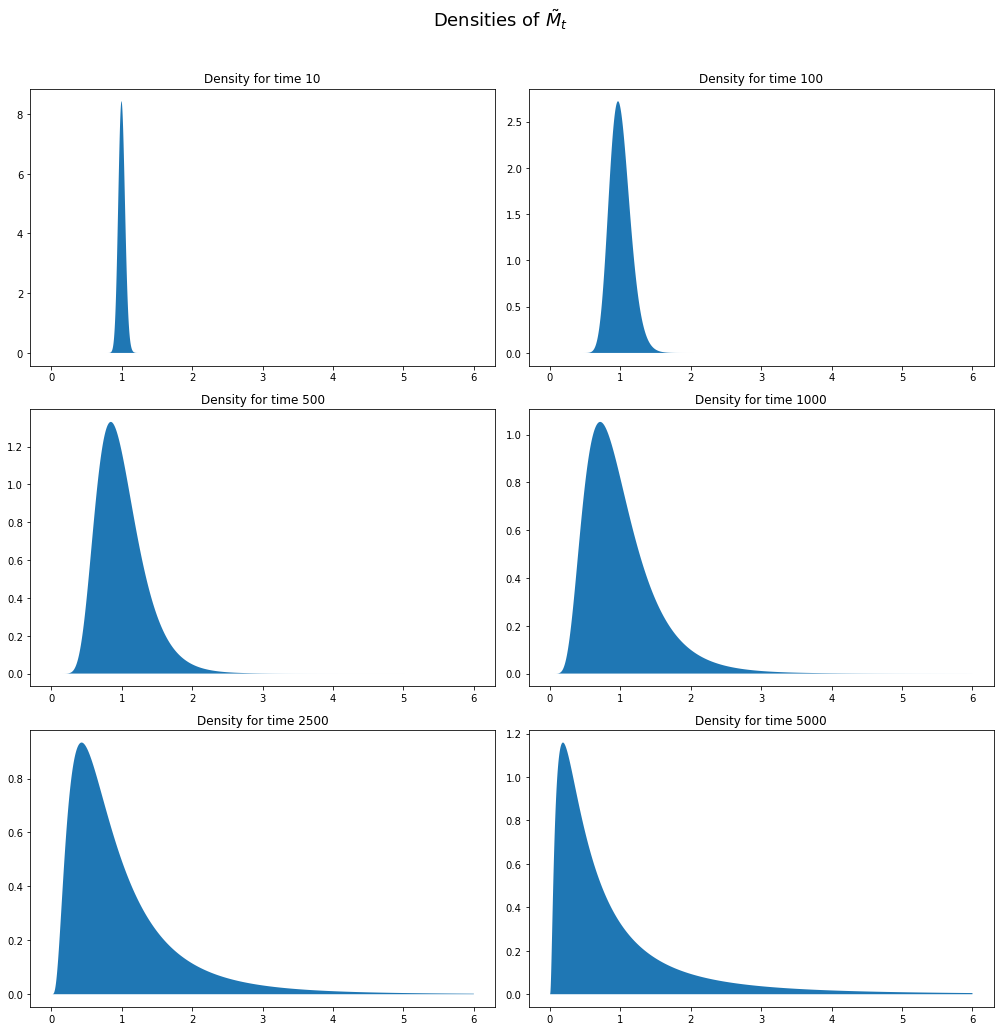

Let’s plot the probability density functions for \(\log {\widetilde M}_t\) for \(t=100, 500, 1000, 10000, 100000\).

Then let’s use the plots to investigate how these densities evolve through time.

We will plot the densities of \(\log {\widetilde M}_t\) for different values of \(t\).

Note: scipy.stats.lognorm expects you to pass the standard deviation

first \((tH \cdot H)\) and then the exponent of the mean as a

keyword argument scale (scale=np.exp(-t * H2 / 2)).

See the documentation here.

This is peculiar, so make sure you are careful in working with the log normal distribution.

Here is some code that tackles these tasks

def Mtilde_t_density(amf, t, xmin=1e-8, xmax=5.0, npts=5000):

# Pull out the multiplicative decomposition

νtilde, H, g = amf.multiplicative_decomp()

H2 = H*H

# The distribution

mdist = lognorm(np.sqrt(t*H2), scale=np.exp(-t*H2/2))

x = np.linspace(xmin, xmax, npts)

pdf = mdist.pdf(x)

return x, pdf

def logMtilde_t_density(amf, t, xmin=-15.0, xmax=15.0, npts=5000):

# Pull out the multiplicative decomposition

νtilde, H, g = amf.multiplicative_decomp()

H2 = H*H

# The distribution

lmdist = norm(-t*H2/2, np.sqrt(t*H2))

x = np.linspace(xmin, xmax, npts)

pdf = lmdist.pdf(x)

return x, pdf

times_to_plot = [10, 100, 500, 1000, 2500, 5000]

dens_to_plot = map(lambda t: Mtilde_t_density(amf_2, t, xmin=1e-8, xmax=6.0),

times_to_plot)

ldens_to_plot = map(lambda t: logMtilde_t_density(amf_2, t, xmin=-10.0,

xmax=10.0), times_to_plot)

fig, ax = plt.subplots(3, 2, figsize=(14, 14))

ax = ax.flatten()

fig.suptitle(r"Densities of $\tilde{M}_t$", fontsize=18, y=1.02)

for (it, dens_t) in enumerate(dens_to_plot):

x, pdf = dens_t

ax[it].set_title(f"Density for time {times_to_plot[it]}")

ax[it].fill_between(x, np.zeros_like(pdf), pdf)

plt.tight_layout()

plt.show()

These probability density functions help us understand mechanics underlying the peculiar property of our multiplicative martingale

As \(T\) grows, most of the probability mass shifts leftward toward zero.

For example, note that most mass is near \(1\) for \(T =10\) or \(T = 100\) but most of it is near \(0\) for \(T = 5000\).

As \(T\) grows, the tail of the density of \(\widetilde M_T\) lengthens toward the right.

Enough mass moves toward the right tail to keep \(E \widetilde M_T = 1\) even as most mass in the distribution of \(\widetilde M_T\) collapses around \(0\).

29.5.3. Multiplicative Martingale as Likelihood Ratio Process¶

This lecture studies likelihood processes and likelihood ratio processes.

A likelihood ratio process is a multiplicative martingale with mean unity.

Likelihood ratio processes exhibit the peculiar property that naturally also appears here.