Advanced Quantitative Economics with Python

Information and Consumption Smoothing

5. Information and Consumption Smoothing¶

Contents

In addition to what’s in Anaconda, this lecture employs the following libraries:

!pip install --upgrade quantecon

Requirement already up-to-date: quantecon in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (0.5.0)

Requirement already satisfied, skipping upgrade: scipy>=1.0.0 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (1.5.2)

Requirement already satisfied, skipping upgrade: sympy in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (1.6.2)

Requirement already satisfied, skipping upgrade: numba>=0.38 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (0.51.2)

Requirement already satisfied, skipping upgrade: numpy in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (1.19.2)

Requirement already satisfied, skipping upgrade: requests in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (2.24.0)

Requirement already satisfied, skipping upgrade: mpmath>=0.19 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from sympy->quantecon) (1.1.0)

Requirement already satisfied, skipping upgrade: llvmlite<0.35,>=0.34.0.dev0 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from numba>=0.38->quantecon) (0.34.0)

Requirement already satisfied, skipping upgrade: setuptools in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from numba>=0.38->quantecon) (50.3.1.post20201107)

Requirement already satisfied, skipping upgrade: chardet<4,>=3.0.2 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (3.0.4)

Requirement already satisfied, skipping upgrade: urllib3!=1.25.0,!=1.25.1,<1.26,>=1.21.1 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (1.25.11)

Requirement already satisfied, skipping upgrade: certifi>=2017.4.17 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (2020.12.5)

Requirement already satisfied, skipping upgrade: idna<3,>=2.5 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (2.10)

5.1. Overview¶

This lecture studies two consumers who have exactly the same nonfinancial income process and who both conform to the linear-quadratic permanent income of consumption smoothing model described in the quantecon lecture.

The two consumers have different information about future nonfinancial incomes.

One consumer each period receives news in the form of a shock that simultaneously affects both today’s nonfinancial income and the present value of future nonfinancial incomes in a particular way.

The other, less well informed, consumer each period receives a shock that equals the part of today’s nonfinancial income that could not be forecast from all past values of nonfinancial income.

Even though they receive exactly the same nonfinancial incomes each period, our two consumers behave differently because they have different information about their future nonfinancial incomes.

The second consumer receives less information about future nonfinancial incomes in a sense that we shall make precise below.

This difference in their information sets manifests itself in their responding differently to what they regard as time \(t\) information shocks.

Thus, while they receive exactly the same histories of nonfinancial income, our two consumers receive different shocks or news about their future nonfinancial incomes.

We compare behaviors of our two consumers as a way to learn about

operating characteristics of the linear-quadratic permanent income model

how the Kalman filter introduced in this lecture and/or the theory of optimal forecasting introduced in this lecture embody lessons that can be applied to the news and noise literature

various ways of representing and computing optimal decision rules in the linear-quadratic permanent income model

a Ricardian equivalence outcome describing effects on optimal consumption of a tax cut at time \(t\) accompanied by a foreseen permanent increases in taxes that is just sufficient to cover the interest payments used to service the risk-free government bonds that are issued to finance the tax cut

a simple application of alternative ways to factor a covariance generating function along lines described in this lecture

This lecture can be regarded as an introduction to some of the invertibility issues that take center stage in the analysis of fiscal foresight by Eric Leeper, Todd Walker, and Susan Yang [LWY13].

5.2. Two Representations of the Same Nonfinancial Income Process¶

Where \(\beta \in (0,1)\), we study consequences of endowing a consumer with one of the two alternative representations for the change in the consumer’s nonfinancial income \(y_{t+1} - y_t\).

The first representation, which we shall refer to as the original representation, is

where \(\{\epsilon_t\}\) is an i.i.d. normally distributed scalar process with means of zero and contemporaneous variances \(\sigma_\epsilon^2\).

This representation of the process is used by a consumer who at time \(t\) knows both \(y_t\) and the original shock \(\epsilon_t\) and can use both of them to forecast future \(y_{t+j}\)’s.

Furthermore, as we’ll see below, representation (5.1) has the peculiar property that a positive shock \(\epsilon_{t+1}\) leaves the discounted present value of the consumer’s financial income at time \(t+1\) unaltered.

The second representation of the same \(\{y_t\}\) process is

where \(\{a_t\}\) is another i.i.d. normally distributed scalar process, with means of zero and now variances \(\sigma_a^2 > \sigma_\epsilon^2\).

The two i.i.d. shock variances are related by

so that the variance of the innovation exceeds the variance of the original shock by a multiplicative factor \(\beta^{-2}\).

The second representation is the innovations representation from Kalman filtering theory.

To see how this works, note that equating representations (5.1) and (5.2) for \(y_{t+1} - y_t\) implies \(\epsilon_{t+1} - \beta^{-1} \epsilon_t = a_{t+1} - \beta a_t\), which in turn implies

Solving this difference equation backwards for \(a_{t+1}\) gives, after a few lines of algebra,

which we can also write as

where \(L\) is the one-period lag operator, \(h(L) = \sum_{j=0}^\infty h_j L^j\), \(I\) is the identity operator, and

Let \(g_j \equiv E z_t z_{t-j}\) be the \(j\)th autocovariance of the \(\{y_t - y_{t-1}\}\) process.

Using calculations in the quantecon lecture, where \(z \in C\) is a complex variable, the covariance generating function \(g (z) = \sum_{j=-\infty}^\infty g_j z^j\) of the \(\{y_t - y_{t-1}\}\) process equals

which confirms that \(\{a_t\}\) is a serially uncorrelated process with variance

To verify these claims, just notice that \(g(z) = \beta^{-2} \sigma_\epsilon^2\) implies that the coefficient \(g_0 = \beta^{-2} \sigma_\epsilon^2\) and that \(g_j = 0\) for \(j \neq 0\).

Alternatively, if you are uncomfortable with covariance generating functions, note that we can directly calculate \(\sigma_a^2\) from formula (5.3) according to

5.2.1. Application of Kalman filter¶

We can also obtain representation (5.2) from representation (5.1) by using the Kalman filter.

Thus, from equations associated with the Kalman filter, it can be verified that the steady-state Kalman gain \(K = \beta^2\) and the steady state conditional covariance \(\Sigma = E [(\epsilon_t - \hat \epsilon_t)^2 | y_{t-1}, y_{t-2}, \ldots ] = (1 - \beta^2) \sigma_\epsilon^2\).

In a little more detail, let \(z_t = y_t - y_{t-1}\) and form the state-space representation

and assume that \(\sigma_\epsilon = 1\) for convenience

Compute the steady-state Kalman filter for this system and let \(K\) be the steady-state gain and \(a_{t+1}\) the one-step ahead innovation.

The innovations representation is

By applying formulas for the steady-state Kalman filter, by hand we computed that \(K = \beta^2, \sigma_a^2 = \beta^{-2} \sigma_\epsilon^2 = \beta^{-2},\) and \(\Sigma = (1-\beta^2) \sigma_\epsilon^2\).

We can also obtain these formulas via the classical filtering theory described in this lecture.

5.2.2. News Shocks and Less Informative Shocks¶

Representation (5.1) is cast in terms of a news shock \(\epsilon_{t+1}\) that represents a shock to nonfinancial income coming from taxes, transfers, and other random sources of income changes known to a well-informed person having all sorts of information about the income process.

Representation (5.2) for the same income process is driven by shocks \(a_t\) that contain less information than the news shock \(\epsilon_t\).

Representation (5.2) is called the innovations representation for the \(\{y_t - y_{t-1}\}\) process.

It is cast in terms of what time series statisticians call the innovation or fundamental shock that emerges from applying the theory of optimally predicting nonfinancial income based solely on the information contained solely in past levels of growth in nonfinancial income.

Fundamental for the \({y_t}\) process means that the shock \(a_t\) can be expressed as a square-summable linear combination of \(y_t, y_{t-1}, \ldots\).

The shock \(\epsilon_t\) is not fundamental and has more information about the future of the \(\{y_t - y_{t-1}\}\) process than is contained in \(a_t\).

Representation (5.3) reveals the important fact that the original shock \(\epsilon_t\) contains more information about future \(y\)’s than is contained in the semi-infinite history \(y^t = [y_t, y_{t-1}, \ldots ]\) of current and past \(y\)’s.

Staring at representation (5.3) for \(a_{t+1}\) shows that it consists both of new news \(\epsilon_{t+1}\) as well as a long moving average \((\beta - \beta^{-1})\sum_{j=0}^\infty \beta^j\epsilon_{t-j}\) of old news.

The better informed representation (5.1) asserts that a shock \(\epsilon_{t}\) results in an impulse response to nonfinancial income of \(\epsilon_t\) times the sequence

so that a shock that increases nonfinancial income \(y_t\) by \(\epsilon_t\) at time \(t\) is followed by an increase in future \(y\) of \(\epsilon_t\) times \(1 - \beta^{-1} < 0\) in all subsequent periods.

Because \(1 - \beta^{-1} < 0\), this means that a positive shock of \(\epsilon_t\) today raises income at time \(t\) by \(\epsilon_t\) and then decreases all future incomes by \((\beta^{-1} -1)\epsilon_t\).

This pattern precisely describes the following mental experiment:

The consumer receives a government transfer of \(\epsilon_t\) at time \(t\).

The government finances the transfer by issuing a one-period bond on which it pays a gross one-period risk-free interest rate equal to \(\beta^{-1}\).

In each future period, the government rolls over the one-period bond and so continues to borrow \(\epsilon_t\) forever.

The government imposes a lump-sum tax on the consumer in order to pay just the current interest on the original bond and its successors created by the roll-over operation.

In all future periods \(t+1, t+2, \ldots\), the government levies a lump-sum tax on the consumer of \(\beta^{-1} -1\) that is just enough to pay the interest on the bond.

The present value of the impulse response or moving average coefficients equals \(d_\epsilon(L) = \frac{0}{1 -\beta } =0\), a fact that we’ll see again below.

Representation (5.2), i.e., the innovation representation, asserts that a shock \(a_{t}\) results in an impulse response to nonfinancial income of \(a_t\) times

so that a shock that increases income \(y_t\) by \(a_t\) at time \(t\) can be expected to be followed by an increase in \(y_{t+j}\) of \(a_t\) times \(1 - \beta > 0\) in all future periods \(j=1, 2, \ldots\).

The present value of the impulse response or moving average coefficients for representation (5.2) is \(d_a(\beta) = \frac{1 -\beta^2}{1 -\beta } = (1 + \beta)\), another fact that will be important below.

5.2.3. Representation of \(\epsilon_t\) in Terms of Future \(y\)’s¶

Notice that reprentation (5.1), namely, \(y_{t+1} - y_t = -\beta^{-1} \epsilon_t + \epsilon_{t+1}\) implies the linear difference equation

Solving forward we eventually obtain

This equation shows that \(\epsilon_t\) equals \(\beta\) times the one-step-backwards error in optimally backcasting \(y_t\) based on the future \(y^t_+ \equiv y_{t+1}, y_{t+2}, \ldots ]\) via the optimal backcasting formula

Thus, \(\epsilon_t\) contains exact information about an important linear combination of future nonfinancial income.

5.2.4. Representation in Terms of \(a_t\) Shocks¶

Next notice that representation (5.2), namely, \(y_{t+1} - y_t = - \beta a_t + a_{t+1}\) implies the linear difference equation

Solving this equation backward establishes that the one-step-prediction error \(a_{t+1}\) is

and where the information set is \(y^t = [y_t, y_{t-1}, \ldots ]\), the one step-ahead optimal prediction is

5.2.5. Permanent Income Consumption-Smoothing Model¶

When we computed optimal consumption-saving policies for the two representations using formulas obtained with the difference equation approach described in the quantecon lecture, we obtain:

for a consumer having the information assumed in the news representation (5.1):

for a consumer having the more limited information associated with the innovations representation (5.2):

These formulas agree with outcomes from the Python programs to be reported below using state-space representations and dynamic programming.

Evidently the two consumers behave differently though they receive exactly the same histories of nonfinancial income.

The consumer with information associated with representation (5.1) responds to each shock \(\epsilon_{t+1}\) by leaving his consumption unaltered and saving all of \(\epsilon_{t+1}\) in anticipation of the permanently increased taxes that he will bear in order to service the permanent interest payments on the risk-free bonds that the government has presumably issued to pay for the one-time addition \(\epsilon_{t+1}\) to his time \(t+1\) nonfinancial income.

The consumer with information associated with representation (5.2) responds to a shock \(a_{t+1}\) by increasing his consumption by what he perceives to be the permanent part of the increase in consumption and by increasing his saving by what he perceives to be the temporary part.

We can regard the first consumer as someone whose behavior sharply illustrates the behavior assumed in a classic Ricardian equivalence experiment.

5.3. State Space Representations¶

We can cast our two representations in terms of the following two state space systems

and

where \(\{v_t\}\) and \(\{u_t\}\) are both i.i.d. sequences of univariate standardized normal random variables.

These two alternative income processes are ready to be used in the framework presented in the section “Comparison with the Difference Equation Approach” in the quantecon lecture.

All the code that we shall use below is presented in that lecture.

5.3.1. Computations¶

We shall use Python to form both of the above two state-space representations, using the following parameter values \(\sigma_\epsilon = 1, \sigma_a = \beta^{-1} \sigma_\epsilon = \beta^{-1}\) where \(\beta\) is the same value as the discount factor in the household’s problem in the LQ savings problem in the lecture.

For these two representations, we use the code in the lecture to

compute optimal decision rules for \(c_t, b_t\) for the two types of consumers associated with our two representations of nonfinancial income

use the value function objects \(P, d\) returned by the code to compute optimal values for the two representations when evaluated at the following initial conditions \(x_0 =\)

for each representation.

create instances of the LinearStateSpace class for the two representations of the \(\{y_t\}\) process and use them to obtain impulse response functions of \(c_t\) and \(b_t\) to the respective shocks \(\epsilon_t\) and \(a_t\) for the two representations.

run simulations of \(\{y_t, c_t, b_t\}\) of length \(T\) under both of the representations (later I’ll give some more details about how we’ll run some special versions of these)

We want to solve the LQ problem:

subject to the sequence of constraints

where \(y_t\) follows one of the representations defined above.

Define the control as \(u_t \equiv c_t - \gamma\).

(For simplicity we can assume \(\gamma=0\) below because \(\gamma\) has no effect on the impulse response functions that interest us.)

The state transition equations under our two representations for the nonfinancial income process \(\{y_t\}\) can be written as

and

As usual, we start by importing packages.

import numpy as np

import quantecon as qe

import matplotlib.pyplot as plt

%matplotlib inline

# Set parameters

β, σϵ = 0.95, 1

σa = σϵ / β

R = 1 / β

# Payoff matrices are the same for two representations

RLQ = np.array([[0, 0, 0],

[0, 0, 0],

[0, 0, 1e-12]]) # put penalty on debt

QLQ = np.array([1.])

# Original representation state transition matrices

ALQ1 = np.array([[1, -R, 0],

[0, 0, 0],

[-R, 0, R]])

BLQ1 = np.array([[0, 0, R]]).T

CLQ1 = np.array([[σϵ, σϵ, 0]]).T

# Construct and solve the LQ problem

LQ1 = qe.LQ(QLQ, RLQ, ALQ1, BLQ1, C=CLQ1, beta=β)

P1, F1, d1 = LQ1.stationary_values()

# The optimal decision rule for c

-F1

array([[ 1. , -1. , -0.05]])

Evidently optimal consumption and debt decision rules for the consumer having news representation (5.1) are

# Innovations representation

ALQ2 = np.array([[1, -β, 0],

[0, 0, 0],

[-R, 0, R]])

BLQ2 = np.array([[0, 0, R]]).T

CLQ2 = np.array([[σa, σa, 0]]).T

LQ2 = qe.LQ(QLQ, RLQ, ALQ2, BLQ2, C=CLQ2, beta=β)

P2, F2, d2 = LQ2.stationary_values()

-F2

array([[ 1. , -0.9025, -0.05 ]])

For a consumer having access only to the information associated with the innovations representation (5.2), the optimal decision rules are

Now we construct two Linear State Space models that emerge from using optimal policies \(u_t =- F x_t\) for the control variable.

Take the original representation case as an example,

To have the Linear State Space model of the innovations representation case, we can simply replace the corresponding matrices.

# Construct two Linear State Space models

Sb = np.array([0, 0, 1])

ABF1 = ALQ1 - BLQ1 @ F1

G1 = np.vstack([-F1, Sb])

LSS1 = qe.LinearStateSpace(ABF1, CLQ1, G1)

ABF2 = ALQ2 - BLQ2 @ F2

G2 = np.vstack([-F2, Sb])

LSS2 = qe.LinearStateSpace(ABF2, CLQ2, G2)

In the following we compute the impulse response functions of \(c_t\) and \(b_t\).

J = 5 # Number of coefficients that we want

x_res1, y_res1 = LSS1.impulse_response(j=J)

b_res1 = np.array([x_res1[i][2, 0] for i in range(J)])

c_res1 = np.array([y_res1[i][0, 0] for i in range(J)])

x_res2, y_res2 = LSS2.impulse_response(j=J)

b_res2 = np.array([x_res2[i][2, 0] for i in range(J)])

c_res2 = np.array([y_res2[i][0, 0] for i in range(J)])

c_res1 / σϵ, b_res1 / σϵ

(array([1.99997796e-11, 1.89473992e-11, 1.78947621e-11, 1.68421319e-11,

1.57894947e-11]),

array([ 0. , -1.05263158, -1.05263158, -1.05263158, -1.05263158]))

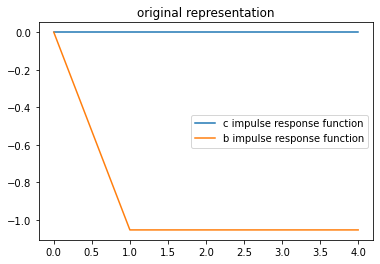

plt.title("original representation")

plt.plot(range(J), c_res1 / σϵ, label="c impulse response function")

plt.plot(range(J), b_res1 / σϵ, label="b impulse response function")

plt.legend()

<matplotlib.legend.Legend at 0x7f1ce4511100>

The above two impulse response functions show that when the consumer has the information assumed in the original representation, his response to receiving a positive shock of \(\epsilon_t\) is to leave his consumption unchanged and to save the entire amount of his extra income and then forever roll over the extra bonds that he holds.

To see this notice, that starting from next period on, his debt permanently decreases by \(\beta^{-1}\)

c_res2 / σa, b_res2 / σa

(array([0.0975, 0.0975, 0.0975, 0.0975, 0.0975]),

array([ 0. , -0.95, -0.95, -0.95, -0.95]))

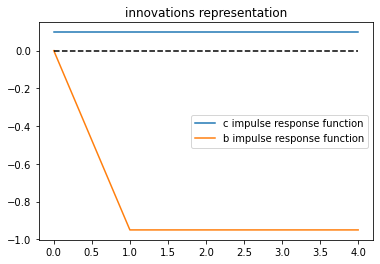

plt.title("innovations representation")

plt.plot(range(J), c_res2 / σa, label="c impulse response function")

plt.plot(range(J), b_res2 / σa, label="b impulse response function")

plt.plot([0, J-1], [0, 0], '--', color='k')

plt.legend()

<matplotlib.legend.Legend at 0x7f1cb8af2fd0>

The above impulse responses show that when the consumer has only the information that is assumed to be available under the innovations representation for \(\{y_t - y_{t-1} \}\), he responds to a positive \(a_t\) by permanently increasing his consumption.

He accomplishes this by consuming a fraction \((1 - \beta^2)\) of the increment \(a_t\) to his nonfinancial income and saving the rest in order to lower \(b_{t+1}\) to finance the permanent increment in his consumption.

The preceding computations confirm what we had derived earlier using paper and pencil.

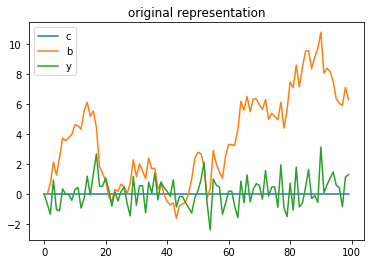

Now let’s simulate some paths of consumption and debt for our two types of consumers while always presenting both types with the same \(\{y_t\}\) path, constructed as described below.

# Set time length for simulation

T = 100

x1, y1 = LSS1.simulate(ts_length=T)

plt.plot(range(T), y1[0, :], label="c")

plt.plot(range(T), x1[2, :], label="b")

plt.plot(range(T), x1[0, :], label="y")

plt.title("original representation")

plt.legend()

<matplotlib.legend.Legend at 0x7f1cb86c2940>

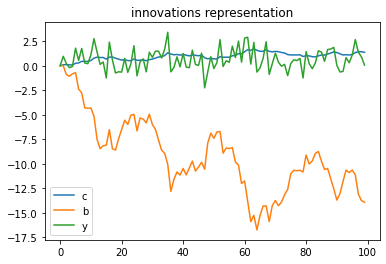

x2, y2 = LSS2.simulate(ts_length=T)

plt.plot(range(T), y2[0, :], label="c")

plt.plot(range(T), x2[2, :], label="b")

plt.plot(range(T), x2[0, :], label="y")

plt.title("innovations representation")

plt.legend()

<matplotlib.legend.Legend at 0x7f1cb8951cd0>

5.3.2. Simulating the Income Process and Two Associated Shock Processes¶

We now describe how we form a single \(\{y_t\}_{t=0}^T\) realization that we will use to simulate the two different decision rules associated with our two types of consumer.

We accomplish this in the following steps.

We form a \(\{y_t, \epsilon_t\}\) realization by drawing a long simulation of \(\{\epsilon_t\}_{t=0}^T\) where \(T\) is a big integer \(\epsilon_t = \sigma_\epsilon v_t\), \(v_t\) is a standard normal scalar, \(y_0 =100\), and

\[ y_{t+1} - y_t =-\beta^{-1} \epsilon_t + \epsilon_{t+1} . \]We take the same \(\{y_t\}\) realization generated in step 1 and form an innovation process \(\{a_t\}\) from the formulas

\[ \begin{aligned} a_0 & = 0 \cr a_t & = \sum_{j=0}^{t-1} \beta^j (y_{t-j} - y_{t-j-1}) + \beta^t a_0, \quad t \geq 1 \end{aligned} \]We throw away the first \(S\) observations and form the sample \(\{y_t, \epsilon_t, a_t\}_{S+1}^T\) as the realization that we’ll use in the following steps.

We use the step 3 realization to evaluate and simulate the decision rules for \(c_t, b_t\) that Python has computed for us above.

The above steps implement the experiment of comparing decisions made by two consumers having identical incomes at each date but at each date having different information about their future incomes.

5.3.3. Calculating Innovations in Another Way¶

Here we use formula (5.3) above to compute \(a_{t+1}\) as a function of the history \(\epsilon_{t+1}, \epsilon_t, \epsilon_{t-1}, \ldots\)

Thus, we compute

We can verify that we recover the same \(\{a_t\}\) sequence computed earlier.

5.3.4. Another Invertibility Issue¶

This quantecon lecture contains another example of a shock-invertibility issue that is endemic to the LQ permanent income or consumption smoothing model.

The technical issue discussed there is ultimately the source of the shock-invertibility issues discussed by Eric Leeper, Todd Walker, and Susan Yang [LWY13] in their analysis of fiscal foresight.