Advanced Quantitative Economics with Python

Default Risk and Income Fluctuations

15. Default Risk and Income Fluctuations¶

Contents

In addition to what’s in Anaconda, this lecture will need the following libraries:

!pip install --upgrade quantecon

Requirement already up-to-date: quantecon in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (0.5.0)

Requirement already satisfied, skipping upgrade: numba>=0.38 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (0.51.2)

Requirement already satisfied, skipping upgrade: scipy>=1.0.0 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (1.5.2)

Requirement already satisfied, skipping upgrade: requests in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (2.24.0)

Requirement already satisfied, skipping upgrade: sympy in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (1.6.2)

Requirement already satisfied, skipping upgrade: numpy in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (1.19.2)

Requirement already satisfied, skipping upgrade: llvmlite<0.35,>=0.34.0.dev0 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from numba>=0.38->quantecon) (0.34.0)

Requirement already satisfied, skipping upgrade: setuptools in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from numba>=0.38->quantecon) (50.3.1.post20201107)

Requirement already satisfied, skipping upgrade: urllib3!=1.25.0,!=1.25.1,<1.26,>=1.21.1 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (1.25.11)

Requirement already satisfied, skipping upgrade: idna<3,>=2.5 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (2.10)

Requirement already satisfied, skipping upgrade: certifi>=2017.4.17 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (2020.6.20)

Requirement already satisfied, skipping upgrade: chardet<4,>=3.0.2 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (3.0.4)

Requirement already satisfied, skipping upgrade: mpmath>=0.19 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from sympy->quantecon) (1.1.0)

15.1. Overview¶

This lecture computes versions of Arellano’s [Are08] model of sovereign default.

The model describes interactions among default risk, output, and an equilibrium interest rate that includes a premium for endogenous default risk.

The decision maker is a government of a small open economy that borrows from risk-neutral foreign creditors.

The foreign lenders must be compensated for default risk.

The government borrows and lends abroad in order to smooth the consumption of its citizens.

The government repays its debt only if it wants to, but declining to pay has adverse consequences.

The interest rate on government debt adjusts in response to the state-dependent default probability chosen by government.

The model yields outcomes that help interpret sovereign default experiences, including

countercyclical interest rates on sovereign debt

countercyclical trade balances

high volatility of consumption relative to output

Notably, long recessions caused by bad draws in the income process increase the government’s incentive to default.

This can lead to

spikes in interest rates

temporary losses of access to international credit markets

large drops in output, consumption, and welfare

large capital outflows during recessions

Such dynamics are consistent with experiences of many countries.

Let’s start with some imports:

import matplotlib.pyplot as plt

import numpy as np

import quantecon as qe

import random

from numba import jit, int64, float64

from numba.experimental import jitclass

%matplotlib inline

15.2. Structure¶

In this section we describe the main features of the model.

15.2.1. Output, Consumption and Debt¶

A small open economy is endowed with an exogenous stochastically fluctuating potential output stream \(\{y_t\}\).

Potential output is realized only in periods in which the government honors its sovereign debt.

The output good can be traded or consumed.

The sequence \(\{y_t\}\) is described by a Markov process with stochastic density kernel \(p(y, y')\).

Households within the country are identical and rank stochastic consumption streams according to

Here

\(0 < \beta < 1\) is a time discount factor

\(u\) is an increasing and strictly concave utility function

Consumption sequences enjoyed by households are affected by the government’s decision to borrow or lend internationally.

The government is benevolent in the sense that its aim is to maximize (15.1).

The government is the only domestic actor with access to foreign credit.

Because household are averse to consumption fluctuations, the government will try to smooth consumption by borrowing from (and lending to) foreign creditors.

15.2.2. Asset Markets¶

The only credit instrument available to the government is a one-period bond traded in international credit markets.

The bond market has the following features

The bond matures in one period and is not state contingent.

A purchase of a bond with face value \(B'\) is a claim to \(B'\) units of the consumption good next period.

To purchase \(B'\) next period costs \(q B'\) now, or, what is equivalent.

For selling \(-B'\) units of next period goods the seller earns \(- q B'\) of today’s goods.

If \(B' < 0\), then \(-q B'\) units of the good are received in the current period, for a promise to repay \(-B'\) units next period.

There is an equilibrium price function \(q(B', y)\) that makes \(q\) depend on both \(B'\) and \(y\).

Earnings on the government portfolio are distributed (or, if negative, taxed) lump sum to households.

When the government is not excluded from financial markets, the one-period national budget constraint is

Here and below, a prime denotes a next period value or a claim maturing next period.

To rule out Ponzi schemes, we also require that \(B \geq -Z\) in every period.

\(Z\) is chosen to be sufficiently large that the constraint never binds in equilibrium.

15.2.3. Financial Markets¶

Foreign creditors

are risk neutral

know the domestic output stochastic process \(\{y_t\}\) and observe \(y_t, y_{t-1}, \ldots,\) at time \(t\)

can borrow or lend without limit in an international credit market at a constant international interest rate \(r\)

receive full payment if the government chooses to pay

receive zero if the government defaults on its one-period debt due

When a government is expected to default next period with probability \(\delta\), the expected value of a promise to pay one unit of consumption next period is \(1 - \delta\).

Therefore, the discounted expected value of a promise to pay \(B\) next period is

Next we turn to how the government in effect chooses the default probability \(\delta\).

15.2.4. Government’s Decisions¶

At each point in time \(t\), the government chooses between

defaulting

meeting its current obligations and purchasing or selling an optimal quantity of one-period sovereign debt

Defaulting means declining to repay all of its current obligations.

If the government defaults in the current period, then consumption equals current output.

But a sovereign default has two consequences:

Output immediately falls from \(y\) to \(h(y)\), where \(0 \leq h(y) \leq y\).

It returns to \(y\) only after the country regains access to international credit markets.

The country loses access to foreign credit markets.

15.2.5. Reentering International Credit Market¶

While in a state of default, the economy regains access to foreign credit in each subsequent period with probability \(\theta\).

15.3. Equilibrium¶

Informally, an equilibrium is a sequence of interest rates on its sovereign debt, a stochastic sequence of government default decisions and an implied flow of household consumption such that

Consumption and assets satisfy the national budget constraint.

The government maximizes household utility taking into account

the resource constraint

the effect of its choices on the price of bonds

consequences of defaulting now for future net output and future borrowing and lending opportunities

The interest rate on the government’s debt includes a risk-premium sufficient to make foreign creditors expect on average to earn the constant risk-free international interest rate.

To express these ideas more precisely, consider first the choices of the government, which

enters a period with initial assets \(B\), or what is the same thing, initial debt to be repaid now of \(-B\)

observes current output \(y\), and

chooses either

to default, or

to pay \(-B\) and set next period’s debt due to \(-B'\)

In a recursive formulation,

state variables for the government comprise the pair \((B, y)\)

\(v(B, y)\) is the optimum value of the government’s problem when at the beginning of a period it faces the choice of whether to honor or default

\(v_c(B, y)\) is the value of choosing to pay obligations falling due

\(v_d(y)\) is the value of choosing to default

\(v_d(y)\) does not depend on \(B\) because, when access to credit is eventually regained, net foreign assets equal \(0\).

Expressed recursively, the value of defaulting is

The value of paying is

The three value functions are linked by

The government chooses to default when

and hence given \(B'\) the probability of default next period is

Given zero profits for foreign creditors in equilibrium, we can combine (15.3) and (15.4) to pin down the bond price function:

15.3.1. Definition of Equilibrium¶

An equilibrium is

a pricing function \(q(B',y)\),

a triple of value functions \((v_c(B, y), v_d(y), v(B,y))\),

a decision rule telling the government when to default and when to pay as a function of the state \((B, y)\), and

an asset accumulation rule that, conditional on choosing not to default, maps \((B,y)\) into \(B'\)

such that

The three Bellman equations for \((v_c(B, y), v_d(y), v(B,y))\) are satisfied

Given the price function \(q(B',y)\), the default decision rule and the asset accumulation decision rule attain the optimal value function \(v(B,y)\), and

The price function \(q(B',y)\) satisfies equation (15.5)

15.4. Computation¶

Let’s now compute an equilibrium of Arellano’s model.

The equilibrium objects are the value function \(v(B, y)\), the associated default decision rule, and the pricing function \(q(B', y)\).

We’ll use our code to replicate Arellano’s results.

After that we’ll perform some additional simulations.

We use a slightly modified version of the algorithm recommended by Arellano.

The appendix to [Are08] recommends value function iteration until convergence, updating the price, and then repeating.

Instead, we update the bond price at every value function iteration step.

The second approach is faster and the two different procedures deliver very similar results.

Here is a more detailed description of our algorithm:

Guess a value function \(v(B, y)\) and price function \(q(B', y)\).

At each pair \((B, y)\),

update the value of defaulting \(v_d(y)\).

update the value of continuing \(v_c(B, y)\).

Update the value function \(v(B, y)\), the default rule, the implied ex ante default probability, and the price function.

Check for convergence. If converged, stop – if not, go to step 2.

We use simple discretization on a grid of asset holdings and income levels.

The output process is discretized using Tauchen’s quadrature method.

As we have in other places, we will accelerate our code using Numba.

We start by defining the data structure that will help us compile the class (for more information on why we do this, see the lecture on numba.)

# Define the data information for the jitclass

arellano_data = [

('B', float64[:]), ('P', float64[:, :]), ('y', float64[:]),

('β', float64), ('γ', float64), ('r', float64),

('ρ', float64), ('η', float64), ('θ', float64),

('def_y', float64[:])

]

# Define utility function

@jit(nopython=True)

def u(c, γ):

return c**(1-γ)/(1-γ)

We then define our jitclass that will store various parameters and contain the code that can apply the Bellman operators and determine the savings policy given prices and value functions

@jitclass(arellano_data)

class Arellano_Economy:

"""

Arellano 2008 deals with a small open economy whose government

invests in foreign assets in order to smooth the consumption of

domestic households. Domestic households receive a stochastic

path of income.

Parameters

----------

B : vector(float64)

A grid for bond holdings

P : matrix(float64)

The transition matrix for a country's output

y : vector(float64)

The possible output states

β : float

Time discounting parameter

γ : float

Risk-aversion parameter

r : float

int lending rate

ρ : float

Persistence in the income process

η : float

Standard deviation of the income process

θ : float

Probability of re-entering financial markets in each period

"""

def __init__(

self, B, P, y,

β=0.953, γ=2.0, r=0.017,

ρ=0.945, η=0.025, θ=0.282

):

# Save parameters

self.B, self.P, self.y = B, P, y

self.β, self.γ, self.r, = β, γ, r

self.ρ, self.η, self.θ = ρ, η, θ

# Compute the mean output

self.def_y = np.minimum(0.969 * np.mean(y), y)

def bellman_default(self, iy, EVd, EV):

"""

The RHS of the Bellman equation when the country is in a

defaulted state on their debt

"""

# Unpack certain parameters for simplification

β, γ, θ = self.β, self.γ, self.θ

# Compute continuation value

zero_ind = len(self.B) // 2

cont_value = θ * EV[iy, zero_ind] + (1 - θ) * EVd[iy]

return u(self.def_y[iy], γ) + β*cont_value

def bellman_nondefault(self, iy, iB, q, EV, iB_tp1_star=-1):

"""

The RHS of the Bellman equation when the country is not in a

defaulted state on their debt

"""

# Unpack certain parameters for simplification

β, γ, θ = self.β, self.γ, self.θ

B, y = self.B, self.y

# Compute the RHS of Bellman equation

if iB_tp1_star < 0:

iB_tp1_star = self.compute_savings_policy(iy, iB, q, EV)

c = max(y[iy] - q[iy, iB_tp1_star]*B[iB_tp1_star] + B[iB], 1e-14)

return u(c, γ) + β*EV[iy, iB_tp1_star]

def compute_savings_policy(self, iy, iB, q, EV):

"""

Finds the debt/savings that maximizes the value function

for a particular state given prices and a value function

"""

# Unpack certain parameters for simplification

β, γ, θ = self.β, self.γ, self.θ

B, y = self.B, self.y

# Compute the RHS of Bellman equation

current_max = -1e14

iB_tp1_star = 0

for iB_tp1, B_tp1 in enumerate(B):

c = max(y[iy] - q[iy, iB_tp1]*B[iB_tp1] + B[iB], 1e-14)

m = u(c, γ) + β*EV[iy, iB_tp1]

if m > current_max:

iB_tp1_star = iB_tp1

current_max = m

return iB_tp1_star

We can now write a function that will use this class to compute the solution to our model

@jit(nopython=True)

def solve(model, tol=1e-8, maxiter=10_000):

"""

Given an Arellano_Economy type, this function computes the optimal

policy and value functions

"""

# Unpack certain parameters for simplification

β, γ, r, θ = model.β, model.γ, model.r, model.θ

B = np.ascontiguousarray(model.B)

P, y = np.ascontiguousarray(model.P), np.ascontiguousarray(model.y)

nB, ny = B.size, y.size

# Allocate space

iBstar = np.zeros((ny, nB), int64)

default_prob = np.zeros((ny, nB))

default_states = np.zeros((ny, nB))

q = np.ones((ny, nB)) * 0.95

Vd = np.zeros(ny)

Vc, V, Vupd = np.zeros((ny, nB)), np.zeros((ny, nB)), np.zeros((ny, nB))

it = 0

dist = 10.0

while (it < maxiter) and (dist > tol):

# Compute expectations used for this iteration

EV = P@V

EVd = P@Vd

for iy in range(ny):

# Update value function for default state

Vd[iy] = model.bellman_default(iy, EVd, EV)

for iB in range(nB):

# Update value function for non-default state

iBstar[iy, iB] = model.compute_savings_policy(iy, iB, q, EV)

Vc[iy, iB] = model.bellman_nondefault(iy, iB, q, EV, iBstar[iy, iB])

# Once value functions are updated, can combine them to get

# the full value function

Vd_compat = np.reshape(np.repeat(Vd, nB), (ny, nB))

Vupd[:, :] = np.maximum(Vc, Vd_compat)

# Can also compute default states and update prices

default_states[:, :] = 1.0 * (Vd_compat > Vc)

default_prob[:, :] = P @ default_states

q[:, :] = (1 - default_prob) / (1 + r)

# Check tolerance etc...

dist = np.max(np.abs(Vupd - V))

V[:, :] = Vupd[:, :]

it += 1

return V, Vc, Vd, iBstar, default_prob, default_states, q

and, finally, we write a function that will allow us to simulate the economy once we have the policy functions

def simulate(model, T, default_states, iBstar, q, y_init=None, B_init=None):

"""

Simulates the Arellano 2008 model of sovereign debt

Parameters

----------

model: Arellano_Economy

An instance of the Arellano model with the corresponding parameters

T: integer

The number of periods that the model should be simulated

default_states: array(float64, 2)

A matrix of 0s and 1s that denotes whether the country was in

default on their debt in that period (default = 1)

iBstar: array(float64, 2)

A matrix which specifies the debt/savings level that a country holds

during a given state

q: array(float64, 2)

A matrix that specifies the price at which a country can borrow/save

for a given state

y_init: integer

Specifies which state the income process should start in

B_init: integer

Specifies which state the debt/savings state should start

Returns

-------

y_sim: array(float64, 1)

A simulation of the country's income

B_sim: array(float64, 1)

A simulation of the country's debt/savings

q_sim: array(float64, 1)

A simulation of the price required to have an extra unit of

consumption in the following period

default_sim: array(bool, 1)

A simulation of whether the country was in default or not

"""

# Find index i such that Bgrid[i] is approximately 0

zero_B_index = np.searchsorted(model.B, 0.0)

# Set initial conditions

in_default = False

max_y_default = 0.969 * np.mean(model.y)

if y_init == None:

y_init = np.searchsorted(model.y, model.y.mean())

if B_init == None:

B_init = zero_B_index

# Create Markov chain and simulate income process

mc = qe.MarkovChain(model.P, model.y)

y_sim_indices = mc.simulate_indices(T+1, init=y_init)

# Allocate memory for remaining outputs

Bi = B_init

B_sim = np.empty(T)

y_sim = np.empty(T)

q_sim = np.empty(T)

default_sim = np.empty(T, dtype=bool)

# Perform simulation

for t in range(T):

yi = y_sim_indices[t]

# Fill y/B for today

if not in_default:

y_sim[t] = model.y[yi]

else:

y_sim[t] = np.minimum(model.y[yi], max_y_default)

B_sim[t] = model.B[Bi]

default_sim[t] = in_default

# Check whether in default and branch depending on that state

if not in_default:

if default_states[yi, Bi] > 1e-4:

in_default=True

Bi_next = zero_B_index

else:

Bi_next = iBstar[yi, Bi]

else:

Bi_next = zero_B_index

if np.random.rand() < model.θ:

in_default=False

# Fill in states

q_sim[t] = q[yi, Bi_next]

Bi = Bi_next

return y_sim, B_sim, q_sim, default_sim

15.5. Results¶

Let’s start by trying to replicate the results obtained in [Are08].

In what follows, all results are computed using Arellano’s parameter values.

The values can be seen in the __init__ method of the Arellano_Economy shown above.

For example,

r=0.017matches the average quarterly rate on a 5 year US treasury over the period 1983–2001.

Details on how to compute the figures are reported as solutions to the exercises.

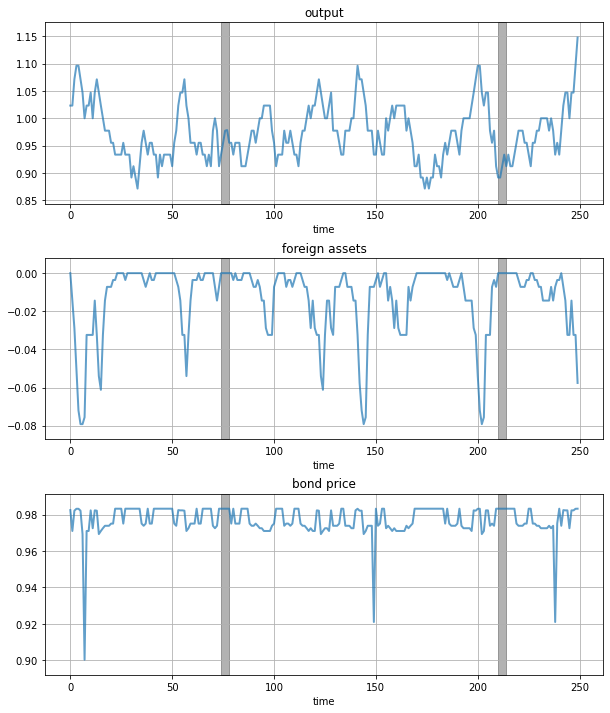

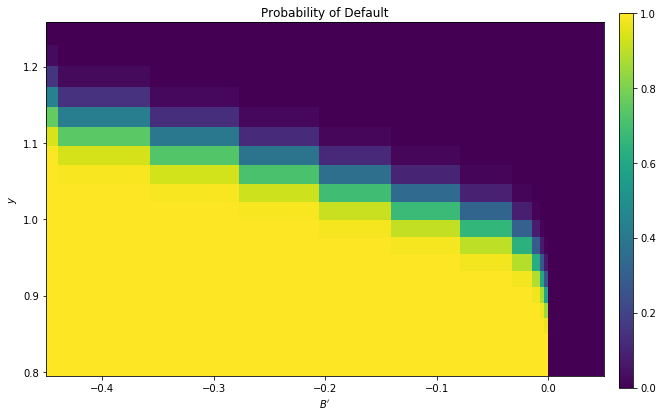

The first figure shows the bond price schedule and replicates Figure 3 of Arellano, where \(y_L\) and \(Y_H\) are particular below average and above average values of output \(y\).

\(y_L\) is 5% below the mean of the \(y\) grid values

\(y_H\) is 5% above the mean of the \(y\) grid values

The grid used to compute this figure was relatively coarse (ny, nB = 21, 251) in order to

match Arrelano’s findings.

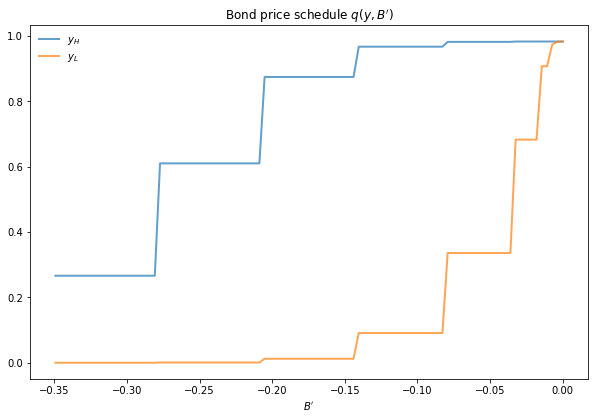

Here’s the same relationships computed on a finer grid (ny, nB = 51, 551)

In either case, the figure shows that

Higher levels of debt (larger \(-B'\)) induce larger discounts on the face value, which correspond to higher interest rates.

Lower income also causes more discounting, as foreign creditors anticipate greater likelihood of default.

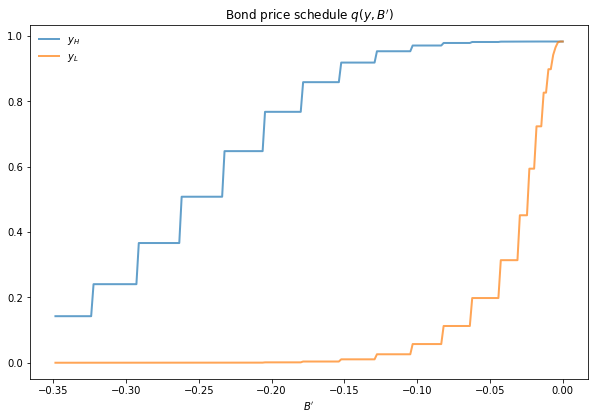

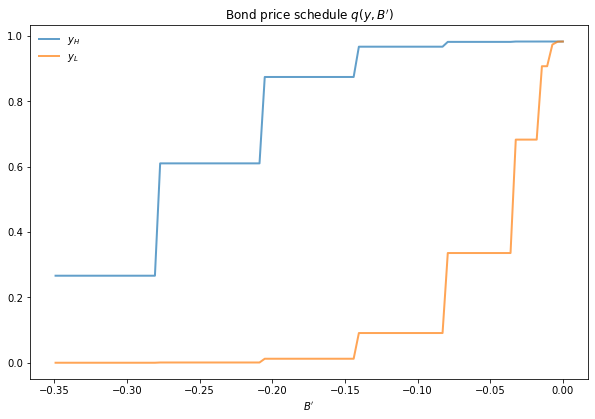

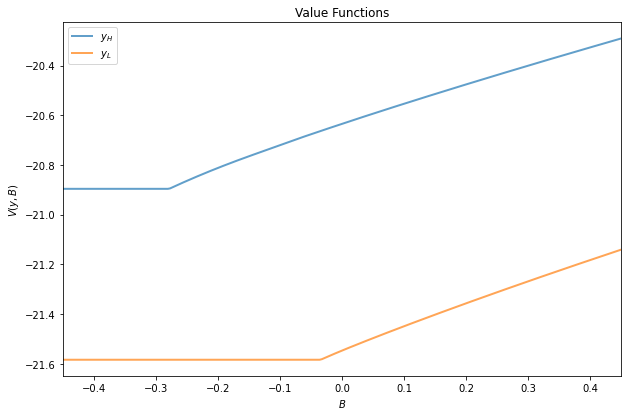

The next figure plots value functions and replicates the right hand panel of Figure 4 of [Are08].

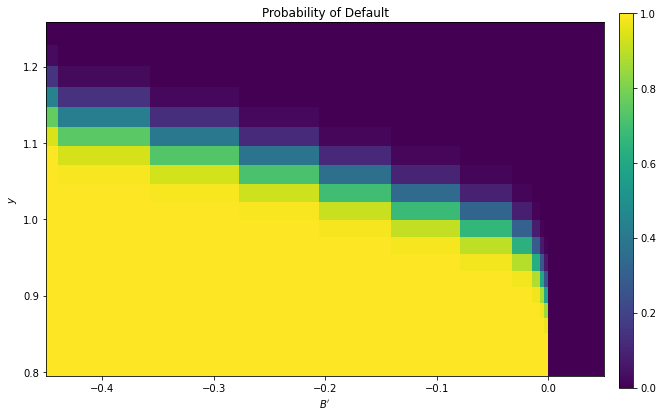

We can use the results of the computation to study the default probability \(\delta(B', y)\) defined in (15.4).

The next plot shows these default probabilities over \((B', y)\) as a heat map.

As anticipated, the probability that the government chooses to default in the following period increases with indebtedness and falls with income.

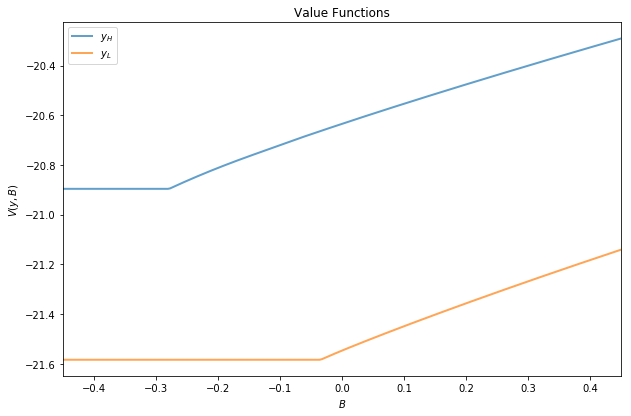

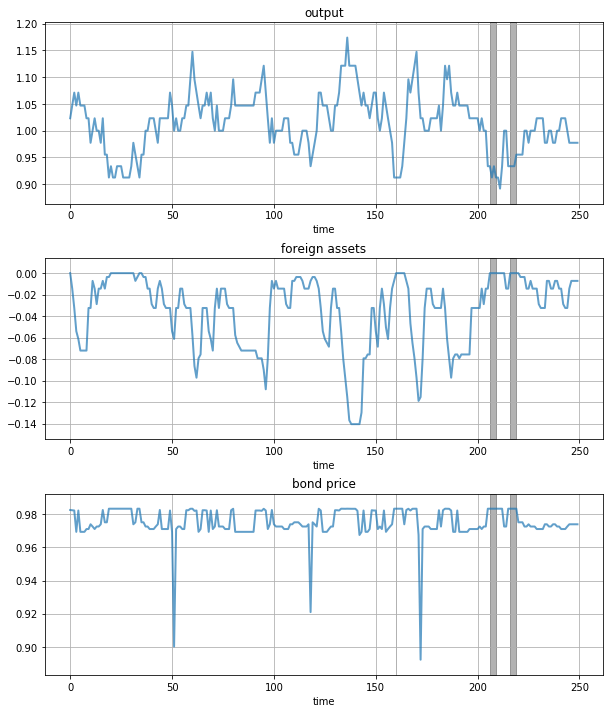

Next let’s run a time series simulation of \(\{y_t\}\), \(\{B_t\}\) and \(q(B_{t+1}, y_t)\).

The grey vertical bars correspond to periods when the economy is excluded from financial markets because of a past default.

One notable feature of the simulated data is the nonlinear response of interest rates.

Periods of relative stability are followed by sharp spikes in the discount rate on government debt.

15.6. Exercises¶

15.6.1. Exercise 1¶

To the extent that you can, replicate the figures shown above

Use the parameter values listed as defaults in the

__init__method of theArellano_Economy.The time series will of course vary depending on the shock draws.

15.7. Solutions¶

Compute the value function, policy and equilibrium prices

β, γ, r = 0.953, 2.0, 0.017

ρ, η, θ = 0.945, 0.025, 0.282

ny = 21

nB = 251

Bgrid = np.linspace(-0.45, 0.45, nB)

mc = qe.markov.tauchen(ρ, η, 0, 3, ny)

ygrid, P = np.exp(mc.state_values), mc.P

ae = Arellano_Economy(

Bgrid, P, ygrid, β=β, γ=γ, r=r, ρ=ρ, η=η, θ=θ

)

V, Vc, Vd, iBstar, default_prob, default_states, q = solve(ae)

Compute the bond price schedule as seen in figure 3 of Arellano (2008)

# Create "Y High" and "Y Low" values as 5% devs from mean

high, low = np.mean(ae.y) * 1.05, np.mean(ae.y) * .95

iy_high, iy_low = (np.searchsorted(ae.y, x) for x in (high, low))

fig, ax = plt.subplots(figsize=(10, 6.5))

ax.set_title("Bond price schedule $q(y, B')$")

# Extract a suitable plot grid

x = []

q_low = []

q_high = []

for i in range(nB):

b = ae.B[i]

if -0.35 <= b <= 0: # To match fig 3 of Arellano

x.append(b)

q_low.append(q[iy_low, i])

q_high.append(q[iy_high, i])

ax.plot(x, q_high, label="$y_H$", lw=2, alpha=0.7)

ax.plot(x, q_low, label="$y_L$", lw=2, alpha=0.7)

ax.set_xlabel("$B'$")

ax.legend(loc='upper left', frameon=False)

plt.show()

Draw a plot of the value functions

# Create "Y High" and "Y Low" values as 5% devs from mean

high, low = np.mean(ae.y) * 1.05, np.mean(ae.y) * .95

iy_high, iy_low = (np.searchsorted(ae.y, x) for x in (high, low))

fig, ax = plt.subplots(figsize=(10, 6.5))

ax.set_title("Value Functions")

ax.plot(ae.B, V[iy_high], label="$y_H$", lw=2, alpha=0.7)

ax.plot(ae.B, V[iy_low], label="$y_L$", lw=2, alpha=0.7)

ax.legend(loc='upper left')

ax.set(xlabel="$B$", ylabel="$V(y, B)$")

ax.set_xlim(ae.B.min(), ae.B.max())

plt.show()

Draw a heat map for default probability

xx, yy = ae.B, ae.y

zz = default_prob

# Create figure

fig, ax = plt.subplots(figsize=(10, 6.5))

hm = ax.pcolormesh(xx, yy, zz)

cax = fig.add_axes([.92, .1, .02, .8])

fig.colorbar(hm, cax=cax)

ax.axis([xx.min(), 0.05, yy.min(), yy.max()])

ax.set(xlabel="$B'$", ylabel="$y$", title="Probability of Default")

plt.show()

<ipython-input-11-3377b9e4ed2e>:6: MatplotlibDeprecationWarning: shading='flat' when X and Y have the same dimensions as C is deprecated since 3.3. Either specify the corners of the quadrilaterals with X and Y, or pass shading='auto', 'nearest' or 'gouraud', or set rcParams['pcolor.shading']. This will become an error two minor releases later.

hm = ax.pcolormesh(xx, yy, zz)

Plot a time series of major variables simulated from the model

T = 250

np.random.seed(42)

y_vec, B_vec, q_vec, default_vec = simulate(ae, T, default_states, iBstar, q)

# Pick up default start and end dates

start_end_pairs = []

i = 0

while i < len(default_vec):

if default_vec[i] == 0:

i += 1

else:

# If we get to here we're in default

start_default = i

while i < len(default_vec) and default_vec[i] == 1:

i += 1

end_default = i - 1

start_end_pairs.append((start_default, end_default))

plot_series = (y_vec, B_vec, q_vec)

titles = 'output', 'foreign assets', 'bond price'

fig, axes = plt.subplots(len(plot_series), 1, figsize=(10, 12))

fig.subplots_adjust(hspace=0.3)

for ax, series, title in zip(axes, plot_series, titles):

# Determine suitable y limits

s_max, s_min = max(series), min(series)

s_range = s_max - s_min

y_max = s_max + s_range * 0.1

y_min = s_min - s_range * 0.1

ax.set_ylim(y_min, y_max)

for pair in start_end_pairs:

ax.fill_between(pair, (y_min, y_min), (y_max, y_max),

color='k', alpha=0.3)

ax.grid()

ax.plot(range(T), series, lw=2, alpha=0.7)

ax.set(title=title, xlabel="time")

plt.show()