Advanced Quantitative Economics with Python

Cattle Cycles

24. Cattle Cycles¶

This is another member of a suite of lectures that use the quantecon DLE class to instantiate models within the [HS13] class of models described in detail in Recursive Models of Dynamic Linear Economies.

In addition to what’s in Anaconda, this lecture uses the quantecon library.

!pip install --upgrade quantecon

Requirement already up-to-date: quantecon in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (0.5.0)

Requirement already satisfied, skipping upgrade: numba>=0.38 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (0.51.2)

Requirement already satisfied, skipping upgrade: sympy in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (1.6.2)

Requirement already satisfied, skipping upgrade: numpy in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (1.19.2)

Requirement already satisfied, skipping upgrade: requests in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (2.24.0)

Requirement already satisfied, skipping upgrade: scipy>=1.0.0 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from quantecon) (1.5.2)

Requirement already satisfied, skipping upgrade: setuptools in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from numba>=0.38->quantecon) (50.3.1.post20201107)

Requirement already satisfied, skipping upgrade: llvmlite<0.35,>=0.34.0.dev0 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from numba>=0.38->quantecon) (0.34.0)

Requirement already satisfied, skipping upgrade: mpmath>=0.19 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from sympy->quantecon) (1.1.0)

Requirement already satisfied, skipping upgrade: urllib3!=1.25.0,!=1.25.1,<1.26,>=1.21.1 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (1.25.11)

Requirement already satisfied, skipping upgrade: certifi>=2017.4.17 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (2020.6.20)

Requirement already satisfied, skipping upgrade: idna<3,>=2.5 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (2.10)

Requirement already satisfied, skipping upgrade: chardet<4,>=3.0.2 in /usr/share/miniconda3/envs/quantecon/lib/python3.8/site-packages (from requests->quantecon) (3.0.4)

This lecture uses the DLE class to construct instances of the “Cattle Cycles” model of Rosen, Murphy and Scheinkman (1994) [RMS94].

That paper constructs a rational expectations equilibrium model to understand sources of recurrent cycles in US cattle stocks and prices.

We make the following imports:

import numpy as np

import matplotlib.pyplot as plt

from quantecon import LQ

from collections import namedtuple

from quantecon import DLE

from math import sqrt

%matplotlib inline

24.1. The Model¶

The model features a static linear demand curve and a “time-to-grow” structure for cattle.

Let \(p_t\) be the price of slaughtered beef, \(m_t\) the cost of preparing an animal for slaughter, \(h_t\) the holding cost for a mature animal, \(\gamma_1 h_t\) the holding cost for a yearling, and \(\gamma_0 h_t\) the holding cost for a calf.

The cost processes \(\{h_t, m_t \}_{t=0}^\infty\) are exogenous, while the price process \(\{p_t \}_{t=0}^\infty\) is determined within a rational expectations equilibrium.

Let \(x_t\) be the breeding stock, and \(y_t\) be the total stock of cattle.

The law of motion for the breeding stock is

where \(g < 1\) is the number of calves that each member of the breeding stock has each year, and \(c_t\) is the number of cattle slaughtered.

The total headcount of cattle is

This equation states that the total number of cattle equals the sum of adults, calves and yearlings, respectively.

A representative farmer chooses \(\{c_t, x_t\}\) to maximize:

subject to the law of motion for \(x_t\), taking as given the stochastic laws of motion for the exogenous processes, the equilibrium price process, and the initial state [\(x_{-1},x_{-2},x_{-3}\)].

Remark The \(\psi_j\) parameters are very small quadratic costs that are included for technical reasons to make well posed and well behaved the linear quadratic dynamic programming problem solved by the fictitious planner who in effect chooses equilibrium quantities and shadow prices.

Demand for beef is government by \(c_t = a_0 - a_1p_t + \tilde d_t\) where \(\tilde d_t\) is a stochastic process with mean zero, representing a demand shifter.

24.2. Mapping into HS2013 Framework¶

24.2.1. Preferences¶

We set \(\Lambda = 0, \Delta_h = 0, \Theta_h = 0, \Pi = \alpha_1^{-\frac{1}{2}}\) and \(b_t = \Pi \tilde d_t + \Pi \alpha_0\).

With these settings, the FOC for the household’s problem becomes the demand curve of the “Cattle Cycles” model.

24.2.2. Technology¶

To capture the law of motion for cattle, we set

(where \(i_t = - c_t\)).

To capture the production of cattle, we set

24.2.3. Information¶

We set

To map this into our class, we set \(f_1^2 = \frac{\Psi_1}{2}\), \(f_2^2 = \frac{\Psi_2}{2}\), \(f_3^2 = \frac{\Psi_3}{2}\), \(2f_1f_2 = 1\), \(2f_3f_4 = \gamma_0g\), \(2f_5f_6 = \gamma_1g\).

# We define namedtuples in this way as it allows us to check, for example,

# what matrices are associated with a particular technology.

Information = namedtuple('Information', ['a22', 'c2', 'ub', 'ud'])

Technology = namedtuple('Technology', ['ϕ_c', 'ϕ_g', 'ϕ_i', 'γ', 'δ_k', 'θ_k'])

Preferences = namedtuple('Preferences', ['β', 'l_λ', 'π_h', 'δ_h', 'θ_h'])

We set parameters to those used by [RMS94]

β = np.array([[0.909]])

lλ = np.array([[0]])

a1 = 0.5

πh = np.array([[1 / (sqrt(a1))]])

δh = np.array([[0]])

θh = np.array([[0]])

δ = 0.1

g = 0.85

f1 = 0.001

f3 = 0.001

f5 = 0.001

f7 = 0.001

ϕc = np.array([[1], [f1], [0], [0], [-f7]])

ϕg = np.array([[0, 0, 0, 0],

[1, 0, 0, 0],

[0, 1, 0, 0],

[0, 0, 1,0],

[0, 0, 0, 1]])

ϕi = np.array([[1], [0], [0], [0], [0]])

γ = np.array([[ 0, 0, 0],

[f1 * (1 - δ), 0, g * f1],

[ f3, 0, 0],

[ 0, f5, 0],

[ 0, 0, 0]])

δk = np.array([[1 - δ, 0, g],

[ 1, 0, 0],

[ 0, 1, 0]])

θk = np.array([[1], [0], [0]])

ρ1 = 0

ρ2 = 0

ρ3 = 0.6

a0 = 500

γ0 = 0.4

γ1 = 0.7

f2 = 1 / (2 * f1)

f4 = γ0 * g / (2 * f3)

f6 = γ1 * g / (2 * f5)

f8 = 1 / (2 * f7)

a22 = np.array([[1, 0, 0, 0],

[0, ρ1, 0, 0],

[0, 0, ρ2, 0],

[0, 0, 0, ρ3]])

c2 = np.array([[0, 0, 0],

[1, 0, 0],

[0, 1, 0],

[0, 0, 15]])

ub = np.array([[πh * a0, 0, 0, πh]])

uh = np.array([[50, 1, 0, 0]])

um = np.array([[100, 0, 1, 0]])

ud = np.vstack(([0, 0, 0, 0],

f2 * uh, f4 * uh, f6 * uh, f8 * um))

<ipython-input-4-568c6d4eae41>:59: VisibleDeprecationWarning: Creating an ndarray from ragged nested sequences (which is a list-or-tuple of lists-or-tuples-or ndarrays with different lengths or shapes) is deprecated. If you meant to do this, you must specify 'dtype=object' when creating the ndarray

ub = np.array([[πh * a0, 0, 0, πh]])

Notice that we have set \(\rho_1 = \rho_2 = 0\), so \(h_t\) and \(m_t\) consist of a constant and a white noise component.

We set up the economy using tuples for information, technology and preference matrices below.

We also construct two extra information matrices, corresponding to cases when \(\rho_3 = 1\) and \(\rho_3 = 0\) (as opposed to the baseline case of \(\rho_3 = 0.6\)).

info1 = Information(a22, c2, ub, ud)

tech1 = Technology(ϕc, ϕg, ϕi, γ, δk, θk)

pref1 = Preferences(β, lλ, πh, δh, θh)

ρ3_2 = 1

a22_2 = np.array([[1, 0, 0, 0],

[0, ρ1, 0, 0],

[0, 0, ρ2, 0],

[0, 0, 0, ρ3_2]])

info2 = Information(a22_2, c2, ub, ud)

ρ3_3 = 0

a22_3 = np.array([[1, 0, 0, 0],

[0, ρ1, 0, 0],

[0, 0, ρ2, 0],

[0, 0, 0, ρ3_3]])

info3 = Information(a22_3, c2, ub, ud)

# Example of how we can look at the matrices associated with a given namedtuple

info1.a22

array([[1. , 0. , 0. , 0. ],

[0. , 0. , 0. , 0. ],

[0. , 0. , 0. , 0. ],

[0. , 0. , 0. , 0.6]])

# Use tuples to define DLE class

econ1 = DLE(info1, tech1, pref1)

econ2 = DLE(info2, tech1, pref1)

econ3 = DLE(info3, tech1, pref1)

# Calculate steady-state in baseline case and use to set the initial condition

econ1.compute_steadystate(nnc=4)

x0 = econ1.zz

econ1.compute_sequence(x0, ts_length=100)

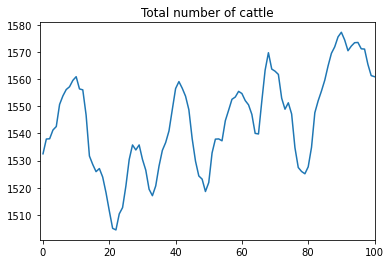

[RMS94] use the model to understand the sources of recurrent cycles in total cattle stocks.

Plotting \(y_t\) for a simulation of their model shows its ability to generate cycles in quantities

# Calculation of y_t

totalstock = econ1.k[0] + g * econ1.k[1] + g * econ1.k[2]

fig, ax = plt.subplots()

ax.plot(totalstock)

ax.set_xlim((-1, 100))

ax.set_title('Total number of cattle')

plt.show()

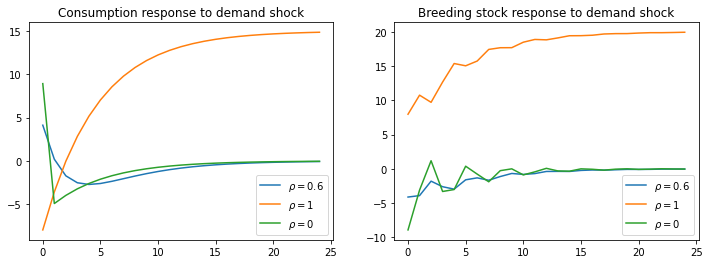

In their Figure 3, [RMS94] plot the impulse response functions of consumption and the breeding stock of cattle to the demand shock, \(\tilde d_t\), under the three different values of \(\rho_3\).

We replicate their Figure 3 below

shock_demand = np.array([[0], [0], [1]])

econ1.irf(ts_length=25, shock=shock_demand)

econ2.irf(ts_length=25, shock=shock_demand)

econ3.irf(ts_length=25, shock=shock_demand)

fig, (ax1, ax2) = plt.subplots(1, 2, figsize=(12, 4))

ax1.plot(econ1.c_irf, label=r'$\rho=0.6$')

ax1.plot(econ2.c_irf, label=r'$\rho=1$')

ax1.plot(econ3.c_irf, label=r'$\rho=0$')

ax1.set_title('Consumption response to demand shock')

ax1.legend()

ax2.plot(econ1.k_irf[:, 0], label=r'$\rho=0.6$')

ax2.plot(econ2.k_irf[:, 0], label=r'$\rho=1$')

ax2.plot(econ3.k_irf[:, 0], label=r'$\rho=0$')

ax2.set_title('Breeding stock response to demand shock')

ax2.legend()

plt.show()

The above figures show how consumption patterns differ markedly, depending on the persistence of the demand shock:

If it is purely transitory (\(\rho_3 = 0\)) then consumption rises immediately but is later reduced to build stocks up again.

If it is permanent (\(\rho_3 = 1\)), then consumption falls immediately, in order to build up stocks to satisfy the permanent rise in future demand.

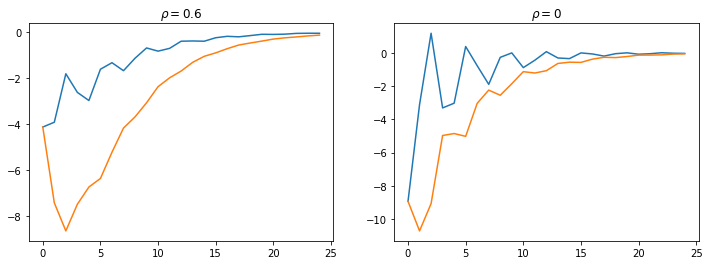

In Figure 4 of their paper, [RMS94] plot the response to a demand shock of the breeding stock and the total stock, for \(\rho_3 = 0\) and \(\rho_3 = 0.6\).

We replicate their Figure 4 below

total1_irf = econ1.k_irf[:, 0] + g * econ1.k_irf[:, 1] + g * econ1.k_irf[:, 2]

total3_irf = econ3.k_irf[:, 0] + g * econ3.k_irf[:, 1] + g * econ3.k_irf[:, 2]

fig, (ax1, ax2) = plt.subplots(1, 2, figsize=(12, 4))

ax1.plot(econ1.k_irf[:, 0], label='Breeding Stock')

ax1.plot(total1_irf, label='Total Stock')

ax1.set_title(r'$\rho=0.6$')

ax2.plot(econ3.k_irf[:, 0], label='Breeding Stock')

ax2.plot(total3_irf, label='Total Stock')

ax2.set_title(r'$\rho=0$')

plt.show()

The fact that \(y_t\) is a weighted moving average of \(x_t\) creates a humped shape response of the total stock in response to demand shocks, contributing to the cyclicality seen in the first graph of this lecture.